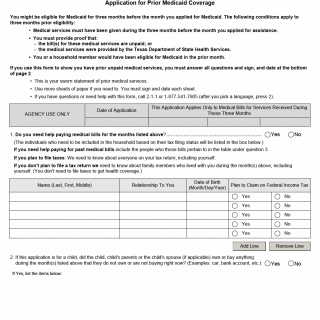

TX HHS Form H1113. Application for Prior Medicaid Coverage

Form H1113 is used in Texas to request Medicaid coverage for unpaid medical services received up to three months before the month a person applied for Medicaid. This form allows eligible applicants to ask the Health and Human Services Commission (HHSC) to review past medical bills and determine whether Medicaid can retroactively cover those costs.

Purpose of Form H1113

The main purpose of Form H1113 is to document prior medical expenses and household circumstances so HHSC can decide whether an applicant or household member qualifies for retroactive Medicaid coverage. It applies only to medical services provided during the three months immediately before the Medicaid application month.

This form is especially important for people who delayed applying for Medicaid but incurred medical bills during a period when they may have met eligibility requirements.

When This Form Must Be Filed

Form H1113 must be filed if all of the following apply:

- Medical services were received during the three months before the Medicaid application month

- The medical bills are unpaid, or the services were provided by the Texas Department of State Health Services

- The applicant or a household member would have been eligible for Medicaid during those months

The form is not required if there are no unpaid medical bills from the prior three-month period or if the applicant is not seeking retroactive Medicaid coverage.

Who Is Allowed to Complete and Sign the Form

The form must be completed and signed by the person applying for prior Medicaid coverage or by an authorized representative acting on their behalf. If the applicant or representative cannot sign, two witnesses are required to sign instead.

Because this is a sworn statement, the person signing is legally responsible for the accuracy of the information provided.

Explanation of Each Key Section

Household and Tax Information

This section identifies household members based on tax filing status or shared living arrangements. HHSC uses this information to determine household size and eligibility during the prior months.

Assets for Child Applicants

If the application is for a child, this section asks whether the child or their parents owned assets during the prior months that they no longer have. This helps HHSC evaluate eligibility under Medicaid rules.

Income During Prior Months

Applicants must list all income received by household members during the three-month period. This includes wages, benefits, child support, and other income sources.

Unpaid Medical Bills

This section lists unpaid medical expenses such as hospital, doctor, pharmacy, or nursing facility bills. Each entry should clearly identify the patient, provider, and date of service.

Proof and Submission Methods

Applicants must provide proof of the information listed, such as bills, statements, or income records. HHSC accepts documents online, by mobile app, mail, fax, or in person.

Certification and Signature

By signing the form, the applicant certifies that all information is true and complete. The form clearly explains that false statements can lead to criminal charges and repayment of benefits.

Practical Tips for Completing Form H1113

- List only medical services received within the correct three-month period.

- Make sure all unpaid bills are clearly identified and supported by documentation.

- Report income exactly as it was received during those months.

- Sign and date every additional page if extra sheets are used.

- Keep copies of everything submitted for your records.

Common Mistakes to Avoid

- Including medical bills outside the allowed three-month window

- Failing to provide proof of unpaid medical expenses

- Leaving income or household member information incomplete

- Forgetting to sign or date the form

- Submitting the form without a related Medicaid application

Legal and Regulatory Context

Form H1113 is governed by Texas Medicaid eligibility rules that allow limited retroactive coverage. State and federal regulations require HHSC to verify income, household composition, and medical need before approving prior Medicaid coverage.

Because the form is a sworn statement, providing false information may result in denial of coverage, repayment obligations, or legal penalties.

Real-Life Examples of When This Form Is Used

- An adult applies for Medicaid in April and requests help paying hospital bills from January through March.

- A family applies for Medicaid for a child after an emergency room visit earlier in the year.

- An applicant received care from a state hospital and needs retroactive Medicaid review.

Documents Commonly Submitted with This Form

- Unpaid medical bills or provider statements

- Income verification for the prior months

- Proof of household composition

- Statements from the Texas Department of State Health Services, if applicable

Frequently Asked Questions

How far back can Medicaid cover medical bills?

Up to three months before the application month, if eligibility requirements were met.

Do I need to file taxes to qualify?

No, tax filing is not required to receive Medicaid.

Does submitting this form guarantee payment?

No, HHSC must first approve eligibility for prior coverage.

Can I submit additional pages?

Yes, but each page must be signed and dated.

What happens if information is incorrect?

Incorrect information may lead to denial, repayment, or penalties.

Related Forms

- Medicaid Application Form (Your Texas Benefits)

- Authorized Representative Form

- Income Verification Forms

- Medical Expense Documentation Forms

Form Details

- Form Name: Application for Prior Medicaid Coverage

- Form Number: H1113

- Issued By: Texas Health and Human Services Commission

- State: Texas

- Revision Date: April 2018