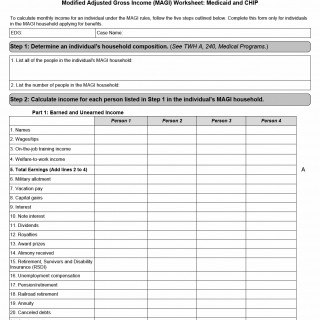

TX HHS Form H1042. Modified Adjusted Gross Income (MAGI) Worksheet

The Modified Adjusted Gross Income (MAGI) Worksheet, also known as TX HHS Form H1042, helps individuals calculate their monthly income for Medicaid and CHIP benefits. This form is specifically designed to assist those applying for benefits under the MAGI rules.

This worksheet guides users through a five-step process to determine their monthly income. It requires information on earned and unearned income, including Social Security benefits and pensions. Users are responsible for accurately completing this form, as it serves as a crucial step in determining eligibility for Medicaid and CHIP benefits.

Key features of the MAGI Worksheet include:

- A five-step process to calculate monthly income

- Required information on earned and unearned income

- A tool for individuals applying for Medicaid and CHIP benefits under the MAGI rules

Geo:

Institution:

SourcePage:

https://www.hhs.texas.gov/regulations/forms/1000-1999/form-h1042-modified-adjusted-gross-income-magi-worksheet