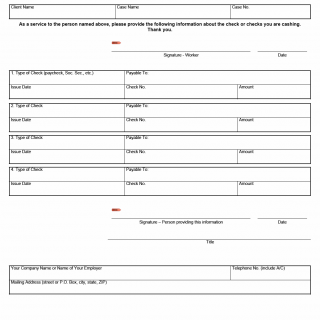

TX HHS Form H1050. Check Verification

Form H1050, also known as the Check Verification form, is used to confirm details about checks being cashed on behalf of a client. This document is typically requested by state agencies or assistance programs when a claimant reports income, payments, or benefits that must be verified before eligibility can be determined. Although the form itself is simple, its purpose is important: it helps agencies confirm the legitimacy, amount, and source of checks cashed by or for the individual.

Purpose of the Form

The form is designed to collect essential information about one or more checks cashed by a client. This information may be necessary for evaluating eligibility for public assistance, tracking income, or clarifying financial transactions that affect a case. The agency relies on the business or employer who cashed the check to supply accurate details.

Who May Complete the Form

- The employer issuing the check

- The business or financial service that cashed the check

- A payment issuer such as a government agency or payroll provider

The client themselves usually does not complete this form. The agency needs the verification to come directly from the check issuer or the business that handled the cashing.

When the Form Is Required

- When a client reports receiving a paycheck, benefit check, or other payment but cannot provide a pay stub or official record

- When checks were cashed informally (e.g., at a store or check-cashing service)

- When the agency needs to confirm the date, amount, type, or origin of a payment

The form is not needed when the client already has acceptable proof such as official benefit statements, employer payroll summaries, or bank transaction records.

Typical Situations Where This Form Is Needed

- A person receiving public benefits cashes a paycheck at a grocery store and must verify the payment for eligibility reviews.

- An individual receives a Social Security check but misplaced the official notice and needs a business to confirm check details.

- A temporary worker gets paid by handwritten checks from a small employer who provides no pay stubs.

- A client’s income review shows inconsistencies, and the agency requests check verification to resolve them.

Explanation of Key Sections

1. Check Information (Payable To, Issue Date, Amount, Type of Check)

These sections ask for basic details about each check. “Type of check” means whether it is a paycheck, Social Security benefit, unemployment payment, or other type of issued payment. Businesses must list the check number, the date it was issued, the amount, and who the check was written to.

Common mistake: Listing the date the check was cashed instead of the date it was issued. The agency needs the issue date for income tracking.

2. Employer or Business Information

This includes the individual’s title, company name, telephone number, and mailing address. Agencies require verifiable contact information to confirm the authenticity of the entry if needed.

3. Signature and Date

The representative signing the form confirms that the information provided is accurate. Submitting the form without a signature is one of the most common reasons for delays.

Legal and Administrative Context

Many state agencies—particularly those administering public assistance programs—are required to verify income or financial resources under state and federal regulations. Form H1050 helps agencies comply with these rules by establishing a documented record of payments made to a client. Providing false information can result in penalties, overpayment recovery, or suspension of benefits.

Practical Tips for Completing the Form

- Provide complete employer or business information to avoid verification delays.

- Double-check that check numbers and amounts match original records.

- List the correct type of check (e.g., paycheck, Social Security payment).

- Ensure the form is signed by an authorized representative.

- If multiple checks were cashed, fill out each line completely to avoid follow-up requests.

Documents Commonly Attached

- Photocopies of the checks (if available)

- Receipts or transaction slips from check-cashing services

- A letter from the employer confirming payments

- Benefit award letters for government-issued checks

FAQ

- Why does the agency request this form? It allows the agency to confirm payment amounts and dates when other proof is unavailable.

- Can the client complete the form? No. It must be filled out by the employer or business that issued or cashed the check.

- What if the business no longer has records? The client may need to provide alternate proof such as bank records or written employer statements.

- Is a signature required? Yes. Unsigned forms are considered incomplete.

- How many checks can be listed? As many as needed, as long as all available lines are completed accurately.

- Does this form determine eligibility? Not by itself; it is one of several documents used to verify income.

Micro-FAQ

- Purpose? Verify details of cashed checks for a client.

- Who fills it out? The business or employer handling the check.

- Deadline? Usually as soon as the agency requests it.

- Attachments? Copies of checks or receipts if available.

- Submitted to? The requesting state agency or caseworker.

- What checks can be listed? Payroll, benefits, or any issued payment.

- Is the client allowed to complete it? No.

Related Forms

- Proof of Employment forms

- Income Verification forms

- Self-Employment Income Statement

- Benefit Verification forms

Form Details

- Form Name: Check Verification

- Form Number: H1050

- Region: State agency (varies by jurisdiction)

- Revision Date: February 1983