Form BMV 5741. Application for Exemption from Payment of Permissive Tax by Non-Resident Member of the Armed Forces

Form BMV 5741, titled "Application for Exemption from Payment of Permissive Tax by Non-Resident Member of the Armed Forces," is used by non-resident members of the U.S. Armed Forces stationed in Ohio who wish to claim an exemption from paying permissive tax on their motor vehicles.

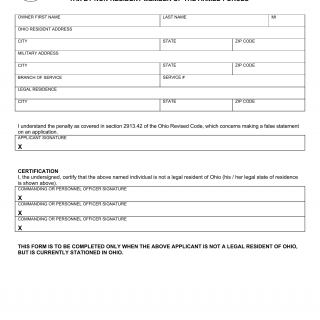

The form typically consists of sections where the military member provides their personal information, such as name, rank, military branch, and station assignment. They must also provide details about the vehicle, including the make, model, year, and vehicle identification number (VIN). The form includes a declaration to attest that they are eligible for the exemption as a non-resident military member stationed in Ohio.

The key fields in this form are the military member's personal information, the vehicle details, and the declaration of eligibility for the tax exemption.

When filling out the form, the military member must ensure that all personal and vehicle information is accurate and that they meet the criteria for the exemption as a non-resident stationed in Ohio. The form should be submitted to the BMV along with any required supporting documents.

An example scenario for using Form BMV 5741 is when a military member from another state is stationed in Ohio and owns a vehicle they wish to exempt from permissive tax. They would complete this form, providing their military and vehicle information and sign the declaration to affirm their eligibility. They would then submit the form to the BMV for processing.

Additional documents required for this form may include proof of military service, station assignment orders, and vehicle registration documents.

Related forms or alternatives may include similar tax exemption forms for military members in other states.