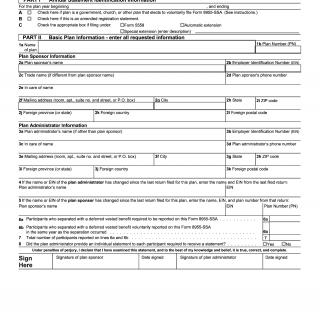

IRS Form 8955-SSA. Annual Registration Statement Identifying Separated Participants With Deferred Vested Benefits

Form 8955-SSA serves a crucial purpose in meeting the reporting obligations outlined in section 6057(a) of the Internal Revenue Code. This form, designed to replace Schedule SSA (Form 5500), stands as an independent reporting document submitted to the Internal Revenue Service (IRS). It is essential to note that Form 8955-SSA must not be submitted alongside Form 5500 or Form 5500-SF.

The primary objective of Form 8955-SSA is to provide accurate and comprehensive information about participants who have separated from employment covered by a retirement plan and who are entitled to deferred vested benefits under that plan. The form is a mechanism for plan administrators to fulfill their responsibilities regarding participants whose vested retirement benefits remain unpaid.

Key scenarios under which Form 8955-SSA is to be filed include:

-

Participants with Unpaid Vested Benefits: Participants who have separated from service covered by the plan but have not yet received their vested retirement benefits. This scenario involves the use of Entry Code A in Part III, line 9, column (a) of the form.

-

Correction of Previously Reported Information: Instances where previously reported participant information requires correction. This is done by utilizing Entry Code B in Part III, line 9, column (a).

-

Transfer of Benefits to a New Plan: Participants previously reported as deferred vested participants in another plan who have transferred their benefits (excluding rollovers) to the plan of a new employer. This scenario employs Entry Code C in Part III, line 9, column (a).

-

Change in Participant Status: Participants previously reported under the plan who have either received their deferred vested benefits or are no longer eligible for them. This involves Entry Code D in Part III, line 9, column (a).

Form 8955-SSA is mainly aimed at providing the Social Security Administration (SSA) with participant information. The SSA then uses this information to assist separated participants when they apply for social security benefits.

It's important to follow specific guidelines when filling out the form. Participant information should be reported exclusively on page 2 of Form 8955-SSA. Additional pages 2 may be used if needed for separated participants; however, adding another page 1, spreadsheets, or nonstandard formats is discouraged.

If there's no information required for a particular year according to the instructions, there's no obligation to file Form 8955-SSA for that year.

Filers have the option to submit Form 8955-SSA electronically through the FIRE system or on paper. The IRS and the SSA encourage electronic filing due to its efficiency and accuracy benefits.

Plan administrators also need to be aware of reporting requirements outlined in section 6057(b), which necessitate notifying the Secretary of the Treasury about certain changes to the plan and the plan administrator. These changes are reported on the plan's Form 5500 return/report in accordance with the Form 5500 instructions.

For assistance with completing Form 8955-SSA, individuals can reach out to the IRS Help Line at 877-829-5500. This toll-free service is available Monday through Friday.

Forms, instructions, and publications, including Form 8955-SSA, can be accessed through the IRS website at IRS.gov. The website offers various resources for tax-related queries, orders of IRS products, and tax news updates.

Lastly, the Internal Revenue Service partners with the National Center for Missing & Exploited Children (NCMEC) to display photographs of missing children on otherwise blank pages of their instructions. Anyone recognizing a missing child from these photographs can contribute to their safe return by contacting 1-800-THE-LOST (1-800-843-5678).