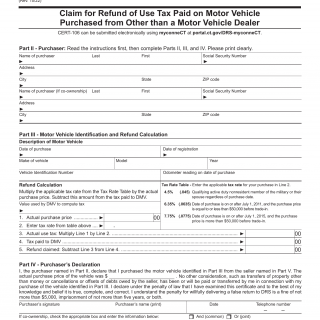

CT DMV Form CERT-106. Claim for Refund of Use Tax Paid

Form CERT-106 - Claim for Refund of Use Tax Paid is used by individuals who have paid use tax on a motor vehicle, boat, or other item and are now eligible for a refund. This form allows taxpayers to request a reimbursement of overpaid use tax.

Form Structure

This form involves the taxpayer as the primary party and the Connecticut DMV as the secondary party. It's structured with sections for taxpayer information, details of the overpaid use tax, and a certification section.

How to Fill Out and Submit the Form

The taxpayer needs to provide accurate personal information, specify the details of the overpaid use tax, and sign the form to certify the refund request. The completed form, along with any required documentation, is submitted to the Connecticut DMV for processing.

Consider a scenario where an individual has purchased a vehicle out of state and paid use tax, only to find out that the use tax was not required. By submitting Form CERT-106, they can request a refund of the overpaid use tax.

While completing the form, remember to provide accurate personal and tax payment information. Additionally, any supporting documentation that proves the overpayment of use tax may be required. An alternative form might not directly correspond, as Form CERT-106 is specific to requesting refunds of overpaid use tax.