TX HHS Form H1049-3. Self-Employment Income Worksheet

The Texas Health and Human Services (HHS) Form H1049-3, Self-Employment Income Worksheet, is a practical tool designed to help self-employed individuals accurately calculate their annual or seasonal monthly self-employment income. This form is typically used by self-employed persons who need to report their income for purposes such as tax returns or financial planning.

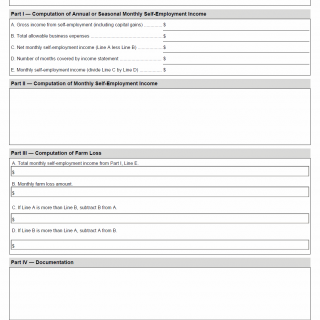

The worksheet consists of four parts: Computation of Annual or Seasonal Monthly Self-Employment Income, Computation of Monthly Self-Employment Income, Computation of Farm Loss, and Documentation Signature. Key features include the computation of gross income from self-employment, total allowable business expenses, and net monthly self-employment income. The form also requires the calculation of monthly farm loss amount and documentation of the signature by HHSC staff.

This form is essential for self-employed individuals to accurately report their income and comply with relevant regulations. By using this worksheet, individuals can ensure that they are properly calculating their self-employment income and meeting their financial obligations. Key points to note include:

- The form is used by self-employed persons to calculate their annual or seasonal monthly self-employment income.

- The computation of gross income from self-employment, total allowable business expenses, and net monthly self-employment income are crucial steps in the process.

- The form requires documentation of the signature by HHSC staff for agency use only.