IRS Form 1128. Application to Adopt, Change or Retain a Tax Year

IRS Form 1128, Application to Adopt, Change or Retain a Tax Year, is an essential document used by businesses and certain individuals for requesting approval from the Internal Revenue Service (IRS) to adopt, change, or retain their tax year. This form plays a crucial role in ensuring proper tax reporting and compliance.

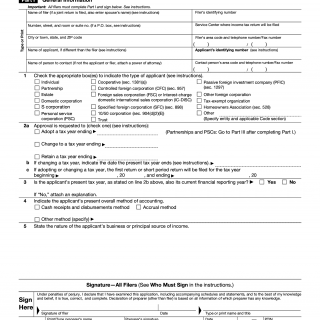

The application consists of specific fields that must be accurately completed to convey the necessary information. When filling out Form 1128, applicants need to provide details about their current tax year, proposed tax year, reasons for the requested change, and any relevant tax law references.

This form primarily serves taxpayers who require a different tax year than the one automatically assigned to them by the IRS. For instance, businesses undergoing mergers, acquisitions, or changes in ownership structure may need to align their tax years to match their new circumstances. Additionally, individuals with unique fiscal situations might request a modification to better align their tax year with their financial operations.

When completing the form, it is crucial to ensure accuracy and thoroughness, as any errors or omissions could lead to delays in processing or potential rejection. Depending on the nature of the request, applicants may need to attach supporting documents such as financial statements, partnership agreements, or corporate resolutions.

Form 1128 has no direct alternatives or analogues, as it is specifically designed for its purpose. However, related forms include Form 8716 (Election To Have a Tax Year Other Than a Required Tax Year) and Form 8752 (Required Payment or Refund Under Section 7519). These forms are used in conjunction with or as supplements to Form 1128 in certain cases.

Once completed, Form 1128 should be submitted to the IRS according to the instructions provided in the form's accompanying guidelines. The form can be filed electronically or sent by mail to the appropriate IRS office based on the taxpayer's location. It is important to retain copies of the form and any supporting documentation for future reference and potential IRS inquiries.

By utilizing Form 1128, taxpayers can effectively communicate their need to adopt, change, or retain a tax year to the IRS, ensuring alignment between their financial operations and tax reporting.