Form LIC 400. Affidavit Regarding Client/Resident Cash Resources - California

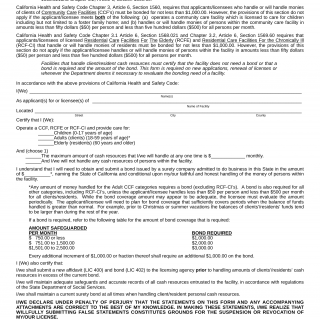

Form LIC 400 is used in California to provide an affidavit regarding client/resident cash resources. The main purpose of this form is to gather information and verify the financial resources of clients or residents in licensed facilities.

The form consists of sections where the licensee gathers information about the client or resident, such as their name, address, and demographic details. It may include fields where the client or resident declares their cash resources, including bank accounts, investments, income sources, and other relevant financial information. The form may also provide space for explanations or attachments if required.

Important fields on this form include accurately documenting the client or resident's personal and financial information, ensuring they understand and truthfully declare their cash resources, and complying with any confidentiality or privacy regulations when handling sensitive financial data. It is important to consider the legal and ethical implications of gathering financial information when completing the form.

Application Example: A residential care facility in California requires residents to disclose their financial resources to determine eligibility for government assistance programs or to assess their ability to pay for services. Form LIC 400 would be used to collect the necessary information, including details about the resident's bank accounts, pensions, Social Security benefits, and other income sources. By completing the form, the licensee ensures transparency and fair assessment of the resident's financial situation, providing appropriate support and guidance.