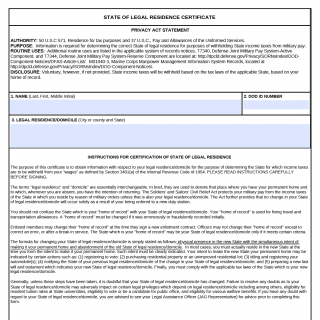

DD Form 2058. State of Legal Residence Certificate

Form DD 2058, also known as the State of Legal Residence Certificate, is a document used by the Department of Defense to determine the state of legal residence of military personnel for various purposes, including taxation and voting. The main purpose of this form is to establish the legal residence of military personnel for purposes other than military pay.

The form consists of several parts, including personal identification information, information about the individual's current and previous states of residence, and a certification of the individual's state of legal residence. Important fields include the individual's name, rank, and military service number, as well as information about the individual's current and previous states of residence.

The parties involved in the compilation of this form include military personnel who are required to establish their state of legal residence for various purposes, as well as military authorities and government agencies who require this information for administrative and legal purposes.

When compiling the form, it is important to provide accurate and up-to-date information about the individual's current and previous states of residence, as well as any relevant documentation, such as tax returns or voter registration records. Additional documents that may need to be attached include any relevant legal documents, such as divorce decrees or court orders.

Application examples and practice and use cases include situations where military personnel are required to establish their state of legal residence for purposes such as voting, taxation, or eligibility for certain government programs. The benefits of this form include providing a clear and concise certification of an individual's state of legal residence, while the risks and challenges include the potential for inaccurate or incomplete information to be reported.

Related and alternative forms include the DD Form 2058-1, which is used to certify the legal residence of military personnel who are married to other military personnel, as well as various state-specific residency forms that may be required for tax or voting purposes. The main differences between these forms are the specific information that is required to be reported and the purposes for which they are used.

The future of the participants can be significantly impacted by the information reported on this form, as it can determine their eligibility for various government programs and benefits, as well as their tax liability. The form is typically submitted through military channels and stored in a secure database for future reference.