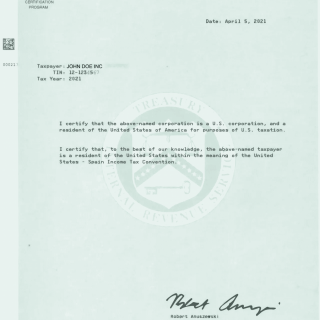

Form 6166, the Certification of U.S. Tax Residency, plays a crucial role in facilitating international tax treaty benefits and transactions for U.S. taxpayers. It is administered by the Internal Revenue Service (IRS) through a structured process outlined in Form 8802, Application for United States Residency Certification. Here is a summary of important information regarding Form 6166 and the application process:

-

Purpose of Form 6166: Form 6166 is a certification that individuals or entities are residents of the United States for federal tax purposes. This certification is often required by foreign countries, financial institutions, and tax authorities to claim treaty benefits and other tax advantages.

-

Use of Form 8802: To obtain Form 6166, applicants must submit Form 8802, which is mandatory for the certification process. The Form 8802 is used to apply for U.S. Residency Certification.

-

Required Information: The application process may require additional information, and these details are typically provided in the Instructions to Form 8802. Applicants should ensure that all required information is submitted accurately.

-

User Fee: There is a user fee associated with processing Form 8802, and this fee may vary based on the type of applicant. The Form 8802 Instructions provide details on the user fee, and it's essential to review this information.

-

Requests for Current Year Certification: Applicants requesting certification for the current year must sign the Form 8802 under penalties of perjury. This attestation confirms their current residency status. If additional information is provided separately (outside of Form 8802), it must also be signed under penalties of perjury.

-

Third-Party Appointees: Taxpayers can appoint a third party to submit Form 8802 on their behalf. In such cases, additional forms may be required to authorize the IRS to interact with the third-party appointee. Refer to the Instructions for Form 8802 for guidance.

-

Special Documentation Requirements: Different types of entities (individuals, partnerships, trusts, corporations, etc.) may have specific documentation requirements. The Instructions for Form 8802 provide information on the documentation required for each entity type.

-

Authorized Signatories: Form 8802 must be signed and dated by an individual who has the authority to do so. The Instructions for Form 8802 list the persons authorized to sign the form.

-

Form 6166 for Value Added Tax (VAT): Form 6166 can be used as proof of U.S. tax residency for obtaining a VAT exemption imposed by a foreign country. However, it certifies only certain aspects of U.S. federal income tax status, not other requirements for VAT exemption.

-

Indonesia Residency Certifications: U.S. taxpayers seeking Indonesian benefits under the U.S.-Indonesia income tax treaty should follow specific guidance from the Indonesian Directorate General of Taxes (DGT). In these cases, U.S. Form 6166 replaces Part III of Indonesia Forms DGT-1 or DGT-2 for Indonesian tax purposes.

-

Certification Denial: If certification is denied, and double taxation issues arise in a treaty jurisdiction, taxpayers can submit requests for relief to the competent authority.

It's essential for U.S. taxpayers and entities involved in international transactions and treaty benefits to be aware of the procedures and requirements associated with Form 6166 and Form 8802. For detailed and up-to-date information, it is advisable to refer to the official IRS resources and consult with a tax professional when necessary.