Form 1095-C appears when health coverage was offered or provided by a large employer subject to the employer shared responsibility rules. It explains how employer-sponsored coverage is reported in the system and why the form is issued without requiring the employee to file or submit it.

What Form 1095-C represents in the system

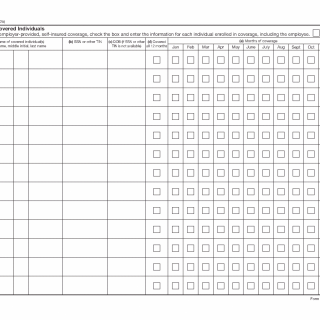

Form 1095-C is an information statement created by an Applicable Large Employer. It documents whether health coverage was offered, the type of offer, and in some cases which individuals were covered under a self-insured plan. The form reflects employer reporting obligations rather than Marketplace enrollment.

Why this form is generated

The form is generated when an employer meets the threshold for large employer reporting and has employees who were full-time for at least part of the year or were covered under a self-insured plan. Issuance of the form is a standard outcome of employer reporting.

What receiving Form 1095-C means

Receiving Form 1095-C confirms that an employer reported coverage information associated with your employment. It does not indicate a penalty, does not require submission, and does not by itself determine tax liability.

What Form 1095-C does not do

Form 1095-C is not attached to a tax return and does not replace income documents. It does not calculate the premium tax credit and does not require action unless referenced as part of a specific coverage question.

When questions usually arise

Questions commonly arise when multiple employers were involved, when the form was not received, or when the employee is unsure whether the form affects tax filing.

If the question is why this form was issued, see why you received Form 1095-C. If the concern is whether anything must be done, see whether you need to do anything with Form 1095-C.

How this form relates to other 1095 forms

Form 1095-C is used only for employer reporting. Coverage through a Marketplace or through insurers and government programs is documented using different 1095 forms.

The distinction between the different 1095 forms is explained in which Form 1095 you received and why.

For the official description of this document, see IRS Form 1095-C document overview.