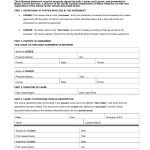

SCDMV Form MC-25. Power of Attorney Authorization Form

The SCDMV Form MC-25, also known as the Power of Attorney Authorization Form, is used to grant someone the legal authority to act on behalf of the vehicle owner in matters related to their vehicle registration or titling. This form specifically applies to motor carriers or companies involved in the transportation of goods.