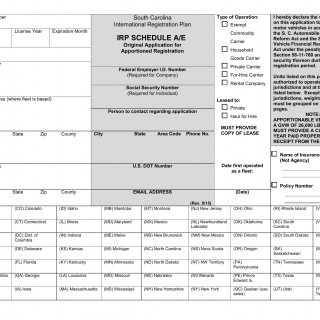

SCDMV Form IRP Schedule A/E. Original Application for Apportioned Registration

This form is used by individuals or businesses who wish to apply for apportioned registration for their commercial vehicles in the state of South Carolina. Apportioned registration allows vehicles to travel and operate in multiple jurisdictions while paying taxes and fees based on the percentage of distance traveled in each jurisdiction.

The form consists of several sections to be completed by the applicant, including general information, vehicle information, and a breakdown of the distance traveled in each jurisdiction. Additionally, the form requires supporting documentation such as proof of insurance and payment for the required fees.

Important fields on this form include the applicant's personal or business information, vehicle information such as the vehicle identification number (VIN) and license plate number, and a detailed breakdown of the distance traveled in each jurisdiction.

When filling out this form, it is important to provide accurate and up-to-date information about the vehicles and the percentage of distance traveled in each jurisdiction. Failure to accurately report this information may result in incorrect tax calculations or penalties.

An example of an application scenario for this form would be a transportation company that operates commercial vehicles across multiple jurisdictions and needs to obtain apportioned registration in order to comply with regulatory requirements and simplify the payment of taxes and fees. By using this form, the company can provide the necessary information to complete the application process.

An alternative form that may be related to this one is SCDMV Form IRP Schedule C/E. This form is used for IRP Renewals. While both forms serve the purpose of applying for apportioned registration, SCDMV Form IRP Schedule A/E is used for the original application, whereas SCDMV Form IRP Schedule C/E is used for renewals of existing apportioned registration.