Form VSA 80. Affidavit of Sale of Levied and Seized Vehicle - Virginia

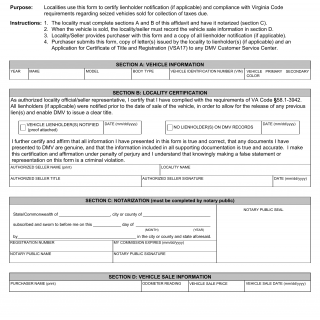

Form VSA 80 - Affidavit of Sale of Levied and Seized Vehicle is used by localities in Virginia to certify lienholder notification and compliance with Virginia Code requirements regarding seized vehicles sold for the collection of taxes due. The parties involved in this form are the localities and the Virginia Department of Motor Vehicles.

The form consists of sections where localities provide information about seized vehicles, lienholder notification (if applicable), and certification of compliance with relevant tax collection laws.

Important fields in this form include details about the seized vehicle, notification status of the lienholder (if applicable), and certification of compliance with tax collection laws. Accurate information is crucial to ensure proper documentation of the vehicle's status and legal compliance.

An example scenario is when a locality seizes a vehicle due to unpaid taxes and plans to sell it to collect the outstanding tax amount. By using Form VSA 80, the locality can certify lienholder notification and compliance with relevant laws, ensuring a legally valid sale of the seized vehicle.

No additional documents are typically required for filling this form. An alternative form could be Form VSA 25, used to apply for a Virginia title for a vehicle with an out-of-state title, which serves a similar purpose but applies to title issuance.