Form MCS 148. Harvest Permit Application - Virginia

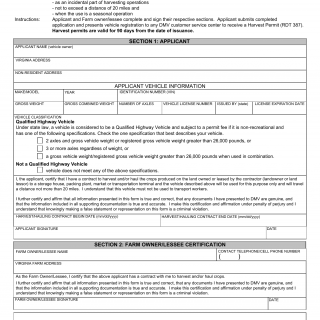

Form MCS 148. Harvest Permit Application is used to apply for a permit to operate a vehicle with out-of-state license plates in Virginia while under contract to harvest and/or haul crops to a storage house, packing plant, market, or transportation terminal. This permit is specifically applicable when the vehicle's use is an incidental part of harvesting operations, does not exceed a distance of 20 miles, and is part of a seasonal operation.

The parties involved in this form are the motor carrier or individual applying for the permit and the Virginia Department of Motor Vehicles (DMV). The form typically consists of sections to provide the vehicle and owner's information, details about the harvest contract, and the specific conditions of the permit.

Important fields in this form include accurate vehicle and owner details, information about the harvesting contract, the specific locations and distances involved, and any supporting documentation related to the seasonal operation. Filling out this form correctly ensures that the vehicle can legally operate with out-of-state plates for the specified purpose.

Example scenario: A farming company from a neighboring state has a contract to harvest crops from a farm in Virginia and transport them to a nearby packing plant. They use Form MCS 148 to apply for a permit to operate their trucks with out-of-state plates within Virginia, adhering to the regulations regarding distance and seasonal operation. The DMV approves the permit, allowing the company's trucks to carry out the specified harvesting activities legally.

Additional documents needed: Along with the form, the applicant may need to provide documentation related to the harvesting contract, proof of insurance, and any other supporting paperwork required by the DMV.

Related form: An alternative form might not be directly related, but carriers transporting goods within Virginia under certain exemptions might use "Form DMV-VMFA1. Farmer's Certificate for Exemption of Sales Tax on Fuels" to claim an exemption from sales tax on fuel purchases used for agricultural purposes.