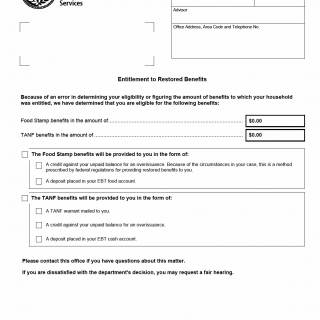

TX HHS Form H1825. Entitlement to Restored Benefits

The TX HHS Form H1825, Entitlement to Restored Benefits, is a crucial document that helps resolve errors in determining eligibility or calculating the amount of benefits for households. This form is used in situations where an error has occurred, resulting in a household being entitled to restored benefits.

This form outlines the specific benefits that are being restored due to the error. The text indicates that the restored benefits may take the form of a credit against an unpaid balance for an overissuance or a deposit placed in an Electronic Benefits Transfer (EBT) account. Additionally, the form provides information on how TANF benefits will be provided, including the possibility of a warrant being mailed to the household.

Key features of this form include the provision of restored benefits in the form of credits or deposits, as well as the opportunity for households to request a fair hearing if they are dissatisfied with the department's decision. It is essential for households to review and understand the information provided on this form to ensure that their restored benefits are accurately calculated and disbursed.

- The form is used in situations where an error has occurred in determining eligibility or calculating the amount of benefits.

- Restored benefits may take the form of a credit against an unpaid balance for an overissuance or a deposit placed in an EBT account.

- The form provides information on how TANF benefits will be provided, including the possibility of a warrant being mailed to the household.