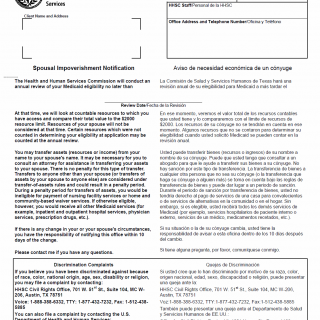

TX HHS Form H1279. Spousal Impoverishment Notification

The Spousal Impoverishment Notification Form H1279 is a crucial document that helps individuals determine their Medicaid eligibility and manage their assets effectively. This form is typically used in situations where an individual's spouse has limited resources, making it essential to understand how these resources impact their own eligibility for Medicaid services.

Key features of this form include the annual review of Medicaid eligibility, which considers countable resources and compares them to a $2000 resource limit. The form also outlines the rules for transferring assets between spouses without penalty, as well as the potential consequences of transferring assets to anyone else. Additionally, the form emphasizes the importance of notifying the office of any changes in circumstances within 10 days.

By completing Form H1279, individuals can ensure that their Medicaid eligibility is accurately determined and that they are aware of their responsibilities and follow-up actions required. This form is an essential tool for anyone navigating the complex process of applying for and managing Medicaid benefits in Texas.

- The Spousal Impoverishment Notification Form H1279 is used to determine Medicaid eligibility and manage assets effectively.

- The form considers countable resources and compares them to a $2000 resource limit during the annual review of Medicaid eligibility.

- Transferring assets between spouses does not incur a penalty, but transferring assets to anyone else may result in a penalty period.

- Individuals must notify the office of any changes in circumstances within 10 days.