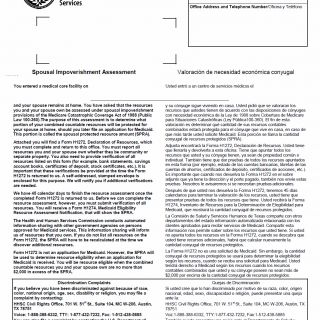

TX HHS Form H1272-A. Spousal Impoverishment Assessment Letter

The Spousal Impoverishment Assessment Letter (Form H1272-A) helps determine the portion of your combined countable resources that will be protected for your spouse at home. This assessment is used in situations where you enter a medical care facility and your spouse remains at home, and you need to apply for Medicaid.

This letter requires you to report all resources you and your spouse own, whether they are community or separate property. You must also provide verification of all listed resources, such as bank statements, savings account books, certificates of deposit, and stock certificates. The form must be completed and returned to the issuing agency within a specified timeframe.

The purpose of this assessment is to determine what portion of your combined countable resources will be protected for your spouse at home. This information will be used to calculate the spousal protected resource amount (SPRA). You will receive a Form H1272, Declaration of Resources, which you must complete and return to the agency. The SPRA will be used to determine resource eligibility when an application for Medicaid is received.

- The form helps determine the portion of your combined countable resources that will be protected for your spouse at home.

- You must report all resources you and your spouse own, including community or separate property.

- Verification of listed resources is required.

- The form must be completed and returned to the issuing agency within a specified timeframe.

Note: I did not include any information about Texas Health and Human Services (HHS) as it was not explicitly mentioned in the text.