TX HHS Form H1252. Designation of Burial Funds

Form H1252 is a Texas Health and Human Services Commission (HHSC) document used to formally designate specific resources as burial funds for Medicaid eligibility purposes. By completing this form, a client or responsible party confirms that certain life insurance policies, financial accounts, or other resources are set aside exclusively for burial expenses and should be treated as exempt assets under Medicaid rules.

Purpose of Form H1252

The main purpose of Form H1252 is to document the intent to reserve specific funds solely for burial or funeral expenses. When properly designated, these resources may be excluded from countable assets during a Medicaid eligibility determination, provided they are not used for any other purpose.

This form helps HHSC distinguish between general financial resources and those legally protected for burial, which can be critical for individuals whose eligibility depends on strict asset limits.

When This Form Must Be Submitted

Form H1252 is required when a Medicaid applicant or recipient wants HHSC to treat certain assets as exempt burial funds. Common situations include:

- Applying for Medicaid with assets near or above eligibility limits

- Designating life insurance cash value for burial purposes

- Setting aside savings or accounts specifically for funeral expenses

- Updating previously designated burial resources

The form is not required if no burial funds are being designated or if assets are already excluded under different Medicaid provisions.

Who Is Authorized to Complete the Form

Form H1252 may be completed and signed by:

- The Medicaid applicant or recipient

- A legally authorized representative or responsible party

In some cases, beneficiaries associated with the designated burial resources may also be required to sign to acknowledge the restriction on use.

Explanation of Key Sections

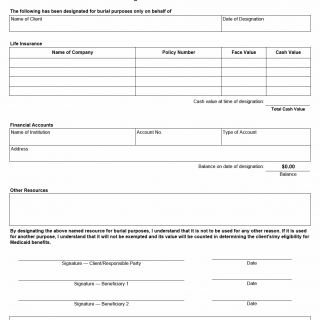

Client and Designation Information

This section identifies the client on whose behalf the burial funds are designated and records the date of designation. The date is important because HHSC evaluates asset status based on timing.

Life Insurance

This section lists any life insurance policies being designated for burial. It includes the insurance company name, policy number, face value, and cash value. The cash value at the time of designation is especially important for Medicaid calculations.

Financial Accounts

Here, the form captures bank or financial institution accounts reserved for burial expenses. Information includes account numbers, account types, institution addresses, and balances as of the designation date.

Other Resources

This section allows additional burial-related resources to be listed if they do not fall under life insurance or standard financial accounts.

Acknowledgment of Use Restriction

This statement confirms that the designated resources may be used only for burial purposes. Using the funds for any other reason makes them countable assets and can affect Medicaid eligibility.

Signatures

The form must be signed and dated by the client or responsible party. Beneficiaries may also sign to acknowledge the designation and restrictions.

Practical Tips for Completing Form H1252

- List only resources that will be used exclusively for burial.

- Ensure balances and cash values are accurate as of the designation date.

- Do not commingle burial funds with other spending accounts.

- Keep copies of statements supporting listed balances.

- Notify HHSC if designated funds are later changed or used.

Common Mistakes to Avoid

- Using designated burial funds for non-burial expenses

- Failing to report accurate cash values or balances

- Not updating HHSC when resources change

- Designating accounts that are actively used for daily expenses

Legal and Regulatory Context

Form H1252 is governed by Texas Medicaid eligibility rules that allow certain burial funds to be excluded from countable resources. HHSC requires clear documentation of intent to ensure that exemptions are applied correctly and consistently.

If designated funds are misused, their value must be counted toward Medicaid asset limits, which may result in denial or termination of benefits.

Real-Life Examples of Use

- An elderly Medicaid applicant designates a small life insurance policy for funeral expenses.

- A responsible party sets aside a savings account solely for burial costs.

- A Medicaid recipient updates burial fund designations after closing an account.

Documents Commonly Submitted with This Form

- Life insurance policy statements

- Bank or financial account statements

- Proof of account ownership

- Medicaid application or redetermination paperwork

Frequently Asked Questions

Does designating burial funds guarantee Medicaid eligibility?

No, it only affects how specific resources are counted.

Can designated funds be used for emergencies?

No, using them for other purposes removes the exemption.

Who must sign Form H1252?

The client or responsible party, and sometimes beneficiaries.

Do burial funds have a maximum exemption limit?

Limits depend on Medicaid rules in effect at the time of review.

Can burial funds be changed later?

Yes, but HHSC must be notified.

What happens if the information is incorrect?

HHSC may request corrections or count the resource.

Related Forms

- Medicaid Application Forms

- Resource Declaration Forms

- Authorized Representative Designation

Form Details

- Form Name: Designation of Burial Funds

- Form Number: H1252

- Issued By: Texas Health and Human Services Commission

- State: Texas

- Revision Date: March 2016