TX HHS Form H1238. Verification of Insurance Policies

Form H1238 is used by state assistance agencies to verify the details of an individual’s life insurance policies. When someone applies for public benefits, certain types of insurance may affect eligibility or benefit amounts. This form allows the caseworker to request verified policy information directly from an insurance company, ensuring that the agency receives accurate, up-to-date financial data.

Although the document looks straightforward, it plays a significant role in confirming assets, calculating surrender values, and determining whether any life insurance policy might be counted as a resource under state regulations.

Purpose and Situations When Form H1238 Is Required

The form is typically required whenever a person applies for assistance programs that involve income or resource screening. These may include Medicaid, TANF, SNAP (in certain cases), or long-term care financial evaluations. Insurance policies with cash value can be considered countable assets, which is why agencies must verify them precisely.

You do not need to submit this form yourself. Instead, the caseworker provides it to the insurer, accompanied by your signed authorization. The insurance company then completes and returns it.

Explanation of Each Section of the Form

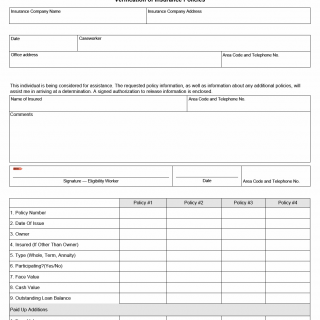

Insurance Company Information

This section identifies the insurer, its address, and contact details. Caseworkers rely on accurate information here to ensure the request reaches the correct department. Insurance companies often have separate units for policy verification, so correctly specifying the address prevents processing delays.

Insured and Applicant Information

The form includes the applicant’s name, the name of the insured (if different), and space for comments. Common comments include clarifying whether the applicant owns multiple small-value policies or whether certain policies have been recently surrendered.

Policy Listings (Policy #1, Policy #2, Policy #3, Policy #4)

Each policy is broken down into structured fields so the insurer can report the exact attributes of the contract:

- Policy Number – The unique identifier for the contract.

- Date of Issue – When the policy was originally purchased.

- Owner – The person legally entitled to make changes or claim cash value.

- Insured – Who the policy covers; this matters when the applicant owns a policy on another person.

- Policy Type – Whole life, term, annuity, etc.

- Participating Status – Indicates whether dividends accumulate.

- Face Value – The death benefit amount.

- Cash Value – The amount available for surrender or borrowing.

- Outstanding Loan Balance – Reduces the net policy value.

Paid-Up Additions

This part documents any extra mini-policies purchased using dividends. These additions increase both face value and cash value. Applicants often overlook them, but they are almost always counted as assets.

Net Policy Surrender Value

One of the most critical fields. This is the amount the applicant would receive if the policy were surrendered today, after deducting loan balances. Agencies use this value to determine whether the policy affects eligibility.

Dividend Options

The insurance company selects how accumulated dividends are handled:

- Paid directly to the owner

- Used to buy additional insurance

- Added to cash value

- Used to reduce future premiums

- Left to accumulate interest

The insurer must also report total accumulated dividends, interest earned for the current year, and the date dividends were last paid.

Common Mistakes Applicants Make

- Believing term life insurance always needs verification (it usually has no cash value and may not be relevant).

- Forgetting about small policies purchased many years ago.

- Not realizing that loans against the policy reduce the surrender value.

- Listing the insured incorrectly—if you own a policy on your child, you are still the owner for resource purposes.

Examples of Real-Life Situations Where This Form Is Used

- A senior applying for long-term care Medicaid owns a whole-life policy purchased 20 years ago. The agency uses Form H1238 to confirm its cash value.

- A single parent applying for benefits has two small burial policies; the insurer verifies whether their surrender value exceeds allowable limits.

- An individual recently borrowed against a life insurance policy. The caseworker uses the form to check the updated loan balance.

Documents Commonly Required Alongside Form H1238

- Signed authorization allowing the insurer to release information.

- Applicant’s ID (provided to the caseworker, not the insurer).

- Any recent policy statements in the applicant’s possession.

Practical Tips for a Smooth Process

- Provide the caseworker with accurate insurer contact information.

- If you suspect a policy has been surrendered or lapsed, mention this early—insurers can confirm status.

- Ask the insurer’s customer service which address handles verification requests to avoid delays.

- If you have multiple policies, list them clearly so the caseworker knows how many forms to request.

FAQ

- Does this form affect my benefits? It does not directly affect benefits; it simply verifies policy values used in the eligibility calculation.

- Do I fill out Form H1238 myself? No. The insurer completes the form after receiving authorization.

- What if my policy has no cash value? The insurer will mark it accordingly; term policies usually do not count as resources.

- How long does verification take? Most companies respond within 7–14 business days, depending on volume.

- Can the agency request multiple verifications? Yes, if you own policies with different insurers or have multiple contracts.

- Will the insurer notify me? Some insurers send a courtesy copy, but not all.

Micro-FAQ (Short Answers for Quick Reference)

- Purpose: To verify life insurance policy values for benefit eligibility.

- Who completes it? The insurance company.

- Who submits it? The caseworker or the insurer, depending on the agency’s process.

- Is it required? Yes, when insurance policies may affect eligibility.

- What attachments are needed? Only the signed authorization form.

- Does it apply to term life? Usually only to confirm the absence of cash value.

- Is cash value always counted? Only according to program-specific rules.

- Deadline? Typically aligned with the caseworker’s eligibility review timeline.

Related Forms

- Statement of Burial Funds (various state versions)

- Assets Verification Request

- Life Insurance Disclosure Form

Form Details

- Form Name: Verification of Insurance Policies

- Form Number: H1238

- State/Agency: Typically used in Texas health and human services programs

- Date of Edition: May 2016