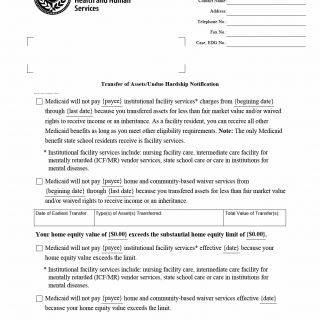

TX HHS Form H1226. Transfer of Assets/Undue Hardship Notification

The TX HHS Form H1226, Transfer of Assets/Undue Hardship Notification, helps individuals who are receiving Medicaid benefits in Texas to notify the state of any asset transfers or undue hardship situations that may affect their eligibility. This form is typically used by facility residents, such as those living in nursing facilities or intermediate care facilities for mentally retarded (ICF/MR), to report changes in their financial situation.

This notification form requires individuals to provide specific information about the assets they have transferred and the date of transfer. The form also outlines the conditions under which Medicaid will not pay for institutional facility services, including nursing facility care, intermediate care facility for mentally retarded (ICF/MR) vendor services, state school care or care in institutions for mental diseases. Additionally, the form notes that individuals can still receive other Medicaid benefits as long as they meet other eligibility requirements.

Key points to note when filling out this form include:

- The transfer of assets for less than fair market value and/or waiving rights to receive income or an inheritance may affect Medicaid eligibility.

- Institutional facility services, such as nursing facility care, will not be paid if the individual has transferred assets for less than fair market value and/or waived rights to receive income or an inheritance.

- The home equity value of $0.00 exceeds the substantial home equity limit of $0.00, affecting Medicaid eligibility.