TX HHS Form H1146-M. Medicaid Report (Manual)

Form H1146-M is an official Medicaid reporting document used by the Texas Health and Human Services Commission (HHSC) for families receiving Transitional Medicaid. This form is required to report changes in household income and child care expenses in order to continue Medicaid coverage for up to 12 months after losing TANF eligibility.

The form helps HHSC verify that a household still meets the conditions for Transitional Medicaid and, in some cases, related child care services. Failure to submit accurate and timely information can result in loss of benefits or legal consequences.

Purpose of Form H1146-M

The primary purpose of Form H1146-M is to allow HHSC to monitor ongoing eligibility for Transitional Medicaid. Families must periodically confirm that they continue to meet employment, income, residency, and household composition requirements.

This form is typically sent to households already enrolled in Transitional Medicaid and must be returned to the local HHSC office within the required timeframe.

Who Must Complete This Form

Form H1146-M must be completed by a responsible adult in the household receiving Transitional Medicaid, usually a parent or caretaker relative.

- Families whose TANF benefits ended due to earnings

- Households with at least one eligible child

- Families continuing to live in Texas

- Households where the caretaker or working adult is employed or has good cause for not working

If the caretaker is not working and cannot demonstrate good cause, eligibility for the remaining months of Transitional Medicaid may be denied.

When This Form Is Required — and When It Is Not

This form must be submitted when:

- HHSC requests an income and child care expense report

- There are changes in earnings, child care costs, or household members

- The household experiences job loss, reduced hours, or employment changes

This form is not required if the household is no longer participating in Transitional Medicaid or if HHSC has not requested updated information.

Explanation of Key Sections

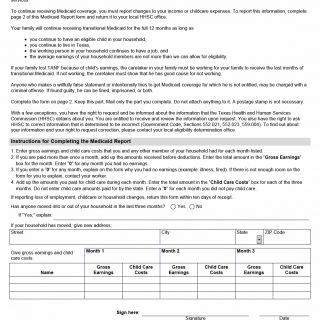

Household Income and Child Care Costs

You must report gross earnings (before taxes or deductions) for each household member for the three listed months. If paid more than once per month, amounts must be totaled for each month.

Child care costs must include only amounts paid by the household. Do not include child care costs paid by the state.

Zero Income Months

If you report zero earnings for any month, you must explain why. Common explanations include illness, termination of employment, or unpaid leave.

Household Changes

You must indicate whether anyone moved into or out of the household in the past three months and provide details if applicable.

Address Changes

If the household has moved, the new address must be provided to ensure accurate case records.

Certification and Signature

The form must be signed and dated. By signing, you certify that the information is true and complete.

Legal and Regulatory Context

Transitional Medicaid is governed by federal Medicaid rules and Texas state policy administered by HHSC. Reporting requirements exist to prevent improper payments and ensure public funds are distributed only to eligible households.

Knowingly providing false information or attempting to obtain Medicaid benefits fraudulently may result in criminal charges, fines, imprisonment, or both.

Common Mistakes to Avoid

- Reporting net income instead of gross earnings

- Failing to explain zero-income months

- Including state-paid child care costs

- Missing the reporting deadline (usually within 10 days)

- Forgetting to sign and date the form

Practical Tips for Completing the Form

- Use pay stubs or employer statements to calculate gross earnings accurately

- Add all payments received in each month before entering totals

- Keep a copy of the completed form for your records

- Mail only the completed page — do not attach documents unless instructed

- Contact your HHSC worker if additional explanation space is needed

Real-Life Situations Where This Form Is Used

- A parent increases work hours and must report higher earnings

- A household stops paying for child care after a schedule change

- A family member moves out, changing household size

- A caretaker temporarily loses employment due to illness

Documents You May Need

Although attachments should not be mailed with this form, you may need the following information to complete it accurately:

- Recent pay stubs

- Child care payment records

- Employment termination or leave documentation

- Household address information

Frequently Asked Questions

How quickly must I return Form H1146-M?

If reporting job loss, child care changes, or household changes, the form must usually be returned within 10 days of receipt.

Do I need to include proof documents?

No. Do not attach documents unless your HHSC worker specifically asks for them.

What happens if I do not return the form?

Your Transitional Medicaid coverage may end before the full 12-month period.

Can I report zero income?

Yes, but you must clearly explain the reason on the form.

Is postage required?

No postage stamp is required when mailing the completed form.

Who can help me if I have questions?

You can contact your local HHSC eligibility determination office.

Micro-FAQ (Quick Answers)

- Purpose: To report income and child care changes for Transitional Medicaid.

- Who files: Families receiving Transitional Medicaid in Texas.

- Deadline: Typically within 10 days of receipt if changes occurred.

- Attachments: None, unless requested.

- Submitted to: Local Texas HHSC office.

- Coverage impact: Determines continued Medicaid eligibility.

Related Forms

- Texas Medicaid Eligibility Review Forms

- TANF Change Report Forms

- HHSC Income Reporting Forms

- Child Care Services Reporting Forms

Form Details

- Form Name: Medicaid Report

- Form Number: H1146-M

- Program: Transitional Medicaid

- State: Texas

- Issuing Authority: Texas Health and Human Services Commission (HHSC)

- Revision Date: July 2004