TX HHS Form H1100. Addendum Income Worksheet

The TX HHS Form H1100 Addendum Income Worksheet is a practical tool designed to help resolve income-related issues in various situations. This form is typically completed by legal parents, stepparents, or applicants/recipients who have diverted income. It helps ensure that income is accurately reported and accounted for in determining eligibility for certain benefits.

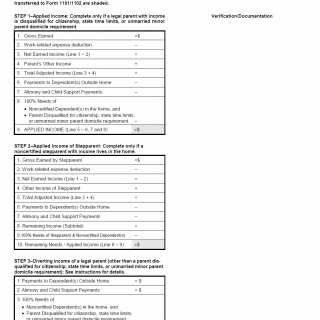

The form consists of three steps: Applied Income, Applied Income of Stepparent, and Diverting Income of a Legal Parent. Step 1-Applied Income requires the reporting of gross earned income, work-related expense deductions, and net earned income. Steps 2-3 involve similar calculations for stepparents or legal parents diverting income. The form also includes sections for payments to dependents outside the home, alimony and child support payments, and remaining needs.

To complete this form effectively, it is essential to follow the instructions provided. Key features include the requirement to attach this sheet to Form 1101/1102 and noting that amounts transferred to these forms are shaded. The form also highlights specific situations where income must be reported, such as when a legal parent or stepparent has income.

- This form is used in situations where a legal parent has income and is disqualified for citizenship, state time limits, or unmarried minor parent domicile requirement.

- The form helps ensure accurate reporting of income to determine eligibility for certain benefits.