TX HHS Form H1016. Supplemental Security Income Referral

Form H1016 is an official referral document used by Texas Health and Human Services Commission (HHSC) to notify the Social Security Administration (SSA) that an individual may be eligible for Supplemental Security Income (SSI). The form creates a formal link between state benefit programs and the federal SSI determination process and documents the outcome of that referral once SSA makes a decision.

Purpose of Form H1016

The primary purpose of Form H1016 is to initiate and track an SSI eligibility review for individuals who are already connected to state assistance programs. It allows HHSC to formally refer a client to SSA, document whether SSI is awarded or denied, and adjust state benefits based on the federal decision.

The form also serves as an official communication record between HHSC and SSA, ensuring that benefit coordination is handled consistently and transparently.

When This Form Must Be Used

Form H1016 is required when HHSC determines that a client receiving or applying for state assistance may qualify for SSI. Common situations include:

- A TANF recipient whose medical or disability condition suggests SSI eligibility

- A foster care youth approaching adulthood who may qualify for SSI

- An HHSC client with documented disabilities and limited income

- A household whose benefit amounts depend on whether a member receives SSI

The form is not used by individuals applying for SSI on their own. It is strictly an interagency referral and reporting document.

Who Is Authorized to Complete the Form

Form H1016 is completed by authorized HHSC representatives, such as eligibility workers or case managers. The client does not complete or submit the form independently.

If the applicant is under age 18 or unable to manage benefits, a representative payee may be identified within the form.

Explanation of Key Sections

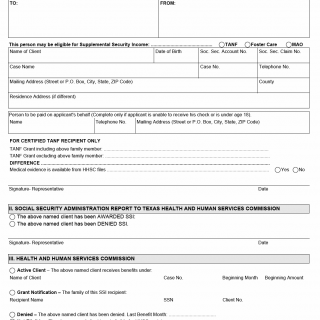

Section I – Referral to Social Security Administration

This section formally refers the individual to SSA for SSI consideration. It includes identifying information such as name, date of birth, Social Security number, contact details, and case information. The referring program (TANF, Foster Care, or Medical Assistance Only) is also identified.

If the applicant cannot receive benefits directly, information about the person to be paid on the applicant’s behalf is included.

TANF Grant Information

For certified TANF recipients, this subsection documents the household grant amount with and without the referred individual. This information is used to calculate potential benefit changes if SSI is approved.

Medical Evidence Availability

This item indicates whether medical evidence supporting disability is already available in HHSC records, which may assist SSA during review.

Section II – Social Security Administration Report

SSA completes this section to report whether the individual was awarded or denied SSI. This confirmation is critical for HHSC to update state benefit eligibility and payment levels.

Section III – Health and Human Services Commission Action

This section documents HHSC’s response after SSA’s decision. It records active benefits, grant notifications, denials, or determinations of ineligibility for state assistance.

Practical Tips for Handling Form H1016

- Ensure all identifying information matches SSA records exactly.

- Confirm the correct referring program is selected.

- Include representative payee information when applicable.

- Verify TANF grant calculations for accuracy.

- Retain copies of the form in the client’s case file.

Common Mistakes to Avoid

- Submitting incomplete or inconsistent personal information

- Failing to indicate available medical evidence

- Incorrectly calculating TANF grant differences

- Using the form for self-referral by clients

- Not updating HHSC records after SSA’s decision

Legal and Regulatory Context

Form H1016 supports coordination between federal SSI programs and Texas state assistance programs. SSI eligibility decisions affect TANF, Medicaid, and other benefits, making accurate reporting legally necessary to ensure proper benefit administration.

Incorrect or missing documentation can lead to improper payments, benefit delays, or compliance issues.

Real-Life Examples of Use

- An HHSC caseworker refers a TANF recipient with a disabling condition to SSA for SSI review.

- A foster youth nearing age 18 is referred for SSI to support transition to adulthood.

- An SSI approval triggers recalculation of a household’s TANF grant.

Documents Commonly Associated with This Form

- Medical records and disability evaluations

- TANF eligibility documentation

- Foster care case records

- SSA award or denial notices

Frequently Asked Questions

Can individuals submit Form H1016 themselves?

No, it is completed and submitted by HHSC only.

Does this form guarantee SSI approval?

No, it only initiates the referral process.

What happens if SSI is denied?

HHSC documents the denial and continues or adjusts state benefits.

Is medical evidence required?

Medical evidence strengthens the referral but may already be on file.

Does SSI approval affect TANF benefits?

Yes, TANF grant amounts may change.

Who completes the SSA decision section?

The Social Security Administration.

Related Forms

- TANF Eligibility Forms

- SSI Application Forms (SSA)

- Medicaid Eligibility Documentation

- Representative Payee Forms

Form Details

- Form Name: Supplemental Security Income Referral

- Form Number: H1016

- Issued By: Texas Health and Human Services Commission

- Region: Texas

- Revision Date: July 2004