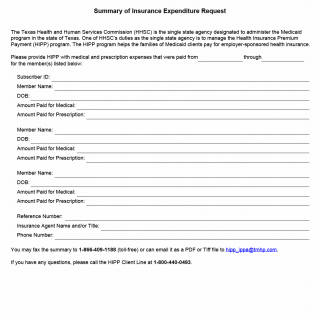

TX HHS Form 5026. HIPP Summary of Insurance Expenditure Request

This document, officially known as Form 5026: Summary of Insurance Expenditure Request, is used within the Texas Health Insurance Premium Payment (HIPP) program. The form allows families to report out-of-pocket medical and prescription expenses for Medicaid-eligible household members who are covered under an employer-sponsored insurance plan. Although the form is short, it plays an important administrative role: it ensures that families receive the correct reimbursement or premium assistance under the HIPP program.

Purpose and Use of the Form

The Texas Health and Human Services Commission (HHSC) requires this form whenever a HIPP participant needs to provide updated information about medical or prescription costs they have paid. These expenses help HHSC verify whether HIPP remains cost-effective and determine whether reimbursement is due.

You generally need to complete this form when:

- You are enrolled in the HIPP program and have paid medical or prescription expenses for a Medicaid household member.

- HIPP requests updated expense information as part of routine eligibility reviews.

- There has been a change in your coverage or medical spending patterns.

Key Sections of Form 5026 Explained

• Subscriber Information

This includes the Subscriber ID and reference number that HIPP uses to find your case. A frequent mistake is entering the employer’s health plan member ID instead of the HIPP Subscriber ID—double-check this to avoid delays.

• Member Details

For each household member covered under employer insurance, you must list:

- Full name

- Date of birth

- Amount paid for medical services

- Amount paid for prescription medications

One common error is reporting billed amounts instead of amounts actually paid. HIPP reimburses based on payments, not charges.

• Insurance Agent Contact Information

This section requests the name and phone number of your employer’s insurance agent or benefits administrator. HHSC may need to verify coverage details or premium changes.

• Submission Instructions

You can return the completed form via fax or email. The preferred formats for email submissions are PDF and TIFF files. Failure to use a readable format may delay processing.

Legal and Program Background

The HIPP program is authorized under federal Medicaid law and operated by HHSC as part of its responsibilities as the state’s single Medicaid agency. The purpose is to reduce state Medicaid spending by helping families enroll in cost-effective employer-sponsored insurance. Form 5026 helps HHSC determine whether the coverage remains cost-effective. Providing accurate information is required to continue receiving HIPP benefits and may affect Medicaid eligibility or reimbursement amounts.

Practical Tips for Completing the Form

- Use actual payment receipts, bank statements, or pharmacy summaries to ensure correct dollar amounts.

- Submit all months requested; partial information may require resubmission.

- If a family member is no longer covered, note it clearly before sending the form.

- When emailing, scan documents clearly—blurry or cut-off images are a common cause of delays.

Examples of When This Form Is Required

- A parent pays $45 for a child’s prescription and needs reimbursement from HIPP.

- An employer changes insurance carriers mid-year, and HHSC requires updated expense data to confirm continued cost-effectiveness.

- A family has unusually high medical costs one month, and HIPP requests verification to adjust premium assistance.

- A Medicaid-eligible child starts specialist treatment, increasing out-of-pocket costs that HIPP must evaluate.

Documents Commonly Attached

- Receipts for medical office visits

- Pharmacy receipts showing medication name and amount paid

- Summary of Benefits or Explanation of Benefits (EOBs)

- Proof of employer insurance premiums (if requested)

FAQ

What is Form 5026 used for?

It is used to report out-of-pocket medical and prescription expenses for HIPP-covered household members.

Who must complete this form?

HIPP participants or applicants who are asked by HHSC to provide updated expense information.

Do I need to include receipts?

Receipts are not always mandatory, but clear documentation helps HHSC verify expenses quickly and avoid follow-up requests.

What if I report incorrect amounts?

Incorrect reporting may delay reimbursement or lead to additional verification requests.

Can this form change my HIPP eligibility?

Yes. Expense information helps HHSC determine whether the insurance remains cost-effective.

How do I submit the form?

You can fax it or email it as a PDF or TIFF file using the addresses provided on the form.

Who do I contact with questions?

You can call the HIPP Client Line at 1-800-440-0493.

Micro-FAQ

- Purpose: To report medical and prescription expenses for HIPP review.

- Who files: HIPP participants or applicants.

- Deadline: As requested by HHSC; delays may affect reimbursement.

- Attachments: Receipts or EOBs (recommended).

- Submitted to: HHSC via fax or email.

- Format: PDF or TIFF for email submissions.

- Required? Yes if HHSC requests updated information.

- One form per member? One form can list multiple members.

- Corrections? You may resubmit corrected information.

- Reason: Helps HHSC evaluate cost-effectiveness of employer insurance.

Related Forms

- HIPP Application Form

- Employer Insurance Verification Form

- Medicaid Eligibility Information Update Form

Form Details

- Name: Summary of Insurance Expenditure Request

- Form Number: Form 5026

- Agency: Texas Health and Human Services Commission (HHSC)

- Program: Health Insurance Premium Payment (HIPP)

- Region: State of Texas

- Revision Date: July 2017