TX HHS Form 1582. Consumer Directed Services Responsibilities

Form 1582 explains the core responsibilities of everyone involved in the Consumer Directed Services (CDS) option in Texas. Unlike agency-based care, CDS gives an individual (or their legally authorized representative) the authority to hire, train, and supervise their own service providers. This document outlines what is expected from the CDS employer, the case manager or service coordinator, and the Financial Management Services Agency (FMSA). Understanding these roles is essential before choosing CDS, as the employer becomes directly responsible for day-to-day management and compliance.

Purpose of Form 1582

Form 1582 serves as a detailed guide to help individuals decide if they can successfully manage services under the CDS option. It clarifies legal obligations, administrative responsibilities, financial oversight, and the working relationship with the FMSA. The form is legally significant because choosing CDS means accepting employer-level responsibilities, including tax reporting and compliance with employment laws.

Key Sections of the Form

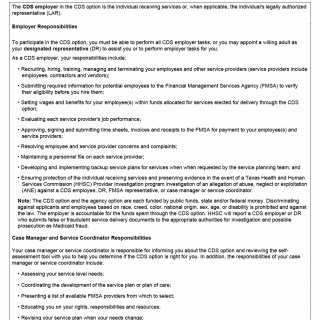

1. Employer Responsibilities

This section outlines what the CDS employer must do to manage their workers. It includes recruiting, training, scheduling, evaluating, and, if necessary, dismissing employees. Employers also handle approval of timesheets, invoices, and budget management within their allocated service funds.

- What this section means: You are taking on full management authority over your service providers—similar to an actual employer–employee relationship.

- Typical mistakes: Hiring workers before the FMSA verifies eligibility, forgetting to submit timesheets on time, or failing to maintain proper documentation.

- When this applies: Any time you choose to receive services through CDS rather than an agency.

- Who can fulfill this role: The individual receiving services or a designated representative (DR) who is a willing adult.

2. Case Manager and Service Coordinator Responsibilities

Case managers and service coordinators help you understand whether CDS is appropriate and work with you to develop a service plan. They are not supervisors of your employees—they provide oversight, guidance, and ensure your services meet program requirements.

- What this section means: You receive support and oversight, but the case manager does not manage your workers.

- Typical mistakes: Expecting the case manager to intervene in employment disputes or schedule workers.

- Why it matters: They ensure you stay within the parameters of Texas Health and Human Services (HHSC) programs.

3. Financial Management Services Agency (FMSA) Responsibilities

The FMSA handles payroll, taxes, background checks, budget approvals, and compliance tasks. They act as your payroll agent with the IRS and state agencies. You must select an FMSA before receiving CDS services.

- What this section means: You manage workers, but the FMSA manages financial reporting and ensures legality.

- Typical mistakes: Not communicating time-sensitive issues to the FMSA or misunderstanding their role as administrative rather than managerial.

4. Additional Employer Responsibilities

This section explains what to do if your FMSA is not meeting expectations. You must attempt direct resolution, then involve your case manager, and finally request a transfer to another approved FMSA if needed.

- Important note: If you leave CDS, you must stay in the agency option for at least 90 days before returning.

5. CDS Advantages vs. Potential Risks

The form concludes with an honest overview of what you gain—and what risks you assume—by choosing CDS.

- Advantages: Freedom to choose workers, flexible scheduling, customizable training, and control over pay rates and benefits.

- Risks: Increased administrative burden, responsibility for conflict resolution, and the need to maintain compliance with employment laws.

Practical Recommendations

- Submit potential employee information to the FMSA before hiring—never onboard workers prematurely.

- Keep organized personnel files for each service provider (ID, training records, evaluations).

- Review your budget monthly to avoid overspending.

- Discuss any service plan changes immediately with your case manager.

- Document any incidents thoroughly to protect the individual receiving services.

Examples of Real-Life Use

- Example 1: A parent of a child with disabilities hires a trusted relative as a personal care aide, managing their schedule and evaluations directly.

- Example 2: An adult with mobility limitations prefers to choose attendants who can work flexible evening hours not offered by agencies.

- Example 3: A person living in a rural area recruits neighbors as service providers when agency staff are unavailable.

- Example 4: A legally authorized representative manages all employment tasks on behalf of an elderly family member.

Documents Commonly Required

- Employee application forms

- Identification documents

- Criminal history check authorizations

- Timesheets and service delivery records

- Budget worksheets approved by the FMSA

Related Forms

- Form 1584 – Consumer Participation Choice

- Form 1722 – Employer's Service Backup Plan

- Form 1735 – Employee Data Sheet

- Form 1739 – CDS Budget

- IRS Forms SS-4 and W-4 (as required by FMSA)

FAQ

- Who is the CDS employer? The person receiving services or their legally authorized representative.

- Can I hire family members? Yes, if they meet program requirements and pass eligibility checks.

- Does the FMSA manage my employees? No, the employer manages all employee tasks; the FMSA handles payroll and compliance.

- Can I switch FMSAs? Yes. If issues cannot be resolved, you may request a transfer through your case manager.

- What happens if I leave CDS? You must use the agency option for at least 90 days before re-enrolling.

- Do I file employment taxes myself? No. The FMSA files employer-related tax forms on your behalf.

- Is discrimination prohibited? Yes. Since CDS uses public funds, federal nondiscrimination laws apply.

Micro-FAQ (Short Answers)

- What is Form 1582? A guide to responsibilities in the Texas CDS option.

- Who completes it? Individuals considering or using CDS and their representatives.

- What does it outline? Employer, FMSA, and case manager responsibilities.

- Why is it required? To ensure informed consent before choosing CDS.

- Where is it used? Texas Health and Human Services programs.

- What attachments may be needed? Employee eligibility forms and budget documents.

- Who processes payroll? The selected FMSA.

- What if my FMSA fails to perform? Report concerns and request a transfer.

- Can I hire before verification? No—wait for FMSA clearance.

- Does CDS allow flexible scheduling? Yes, fully controlled by the employer.

Form Details

- Form Name: Consumer Directed Services (CDS) Responsibilities

- Form Number: 1582

- Region: Texas

- Issuing Agency: Texas Health and Human Services Commission (HHSC)

- Edition Date: November 2019