Texas Secretary of State (SOS) Payment Form (807)

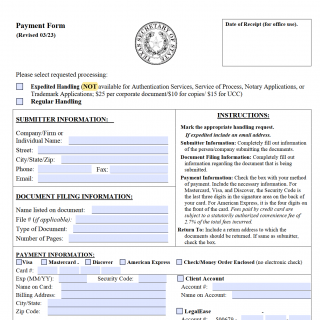

The Texas Payment Form (807) is a form used by the Texas Secretary of State (SOS) to record the payment of fees for various filings and services. The form consists of several parts, including the payment information section, which requires the payor's name, address, telephone number, email address, and payment amount.

The parties involved in this form are the payor and the Texas SOS. It is important to consider the specific instructions provided by the Texas SOS when compiling this form, as well as the payment deadlines and accepted payment methods.

When compiling the form, the payor will need to provide their payment information, including the payment amount and the type of filing or service for which the payment is being made. Additional documents may need to be attached, depending on the specific filing or service.

Examples of applications for this form include paying fees for business entity filings, Uniform Commercial Code (UCC) filings, and trademark registrations. The benefits of using this form include a streamlined payment process and the ability to easily track payments and ensure that they are properly recorded.

The challenges and risks associated with this form include the potential for errors or delays in payment processing, which could result in late fees or other penalties.

Related and alternative forms include the Texas SOS's online payment portal and other payment forms specific to certain filings or services. The main difference between these forms is the specific information and payment requirements for each filing or service.

Submitting the Texas Payment Form (807) can be done by mail or in person at the Texas SOS's office. Once received, the form will be processed and the payment will be recorded in the payor's account with the Texas SOS. It is important to keep a copy of the form for your records.