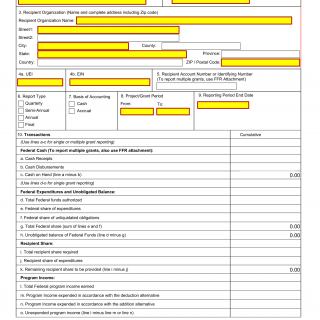

SF 425. Federal Financial Report

SF 425 is a Federal Financial Report form that provides a detailed account of the financial transactions and progress of federal grants, cooperative agreements, loans, and insurance. The form consists of various parts including general information, award information, financial reporting period, and cumulative amounts. The most important fields in the form include accountable Federal agency, recipient name and address, award identification number, amount of federal funds authorized for the award, balance of federal funds remaining, and total federal amount disbursed during the reporting period.

This form is compiled by recipients of federal funds and submitted to the accountable federal agency to comply with the grant terms and conditions. Both the recipient and accountable federal agency are the parties to the document. Recipients must submit this report to the funding agency on a quarterly, semi-annual, or annual basis depending on the grant award conditions.

Features that should be considered when compiling SF 425 include making accurate calculations and recording all financial transactions to ensure that the financial report reflects an accurate representation of the financial status of the project. Recipients must also ensure that the report complies with programmatic and fiscal goals and objectives and adheres to the grant requirements to maintain funding.

The advantages of the SF 425 form include providing a standardized method for reporting the financial status of a grant project, allowing funding agencies to monitor the progress of grants, and ensuring that government funds are being used for their intended purposes. Some problems that can arise when filling out the form include making calculation errors or inaccurate recording of financial transactions that could result in non-compliance and jeopardize funding.

Related forms include SF-270 Request for Advance or Reimbursement and SF-271 Outlay Report and Request for Reimbursement for Construction Programs. Alternative forms include taking advantage of electronic financial report submission options, such as using the Grant Solutions website or third-party accounting software that can produce the required reports.

Recipients submit SF-425 forms to the accountable federal agency, in most cases via electronic submission. The funding agency stores the copy for audit purposes.