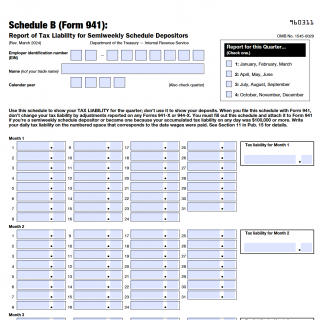

IRS Form 941 Schedule B. Report of Tax Liability for Semiweekly Schedule Depositors

IRS Form 941 Schedule B, also known as the "Report of Tax Liability for Semiweekly Schedule Depositors," is an essential document used by employers to report their tax liabilities for Social Security, Medicare, and federal income taxes withheld from employee wages. This form is specifically designed for semiweekly schedule depositors, which are employers who have accumulated $100,000 or more in tax liabilities on any given day during a monthly or semiweekly deposit period.

Form 941 Schedule B consists of various sections that require specific information to accurately report tax liabilities. Employers need to provide details such as their employer identification number (EIN), the total number of employees, and the amount of wages paid to employees subject to Social Security and Medicare taxes. It also requires reporting the amounts of federal income taxes withheld from employee wages.

When filling out this form, it is crucial to consider the dates covered by the deposit period and ensure accurate calculations of tax liabilities. Employers must carefully review their payroll records and financial statements to gather the necessary data for filling out the form accurately.

No additional documents need to be attached when filing Form 941 Schedule B. However, employers should maintain proper records of their payroll, employment tax calculations, and any other supporting documentation for future reference or potential IRS audits.

This form is applicable to employers who are semiweekly schedule depositors. These employers may have a higher volume of payroll transactions and therefore need to deposit employment taxes more frequently than other types of employers. By using Form 941 Schedule B, employers can effectively report their tax liabilities and ensure compliance with federal tax regulations.

An example of when this form is required is if an employer accumulates $100,000 or more in tax liabilities on any day during a monthly or semiweekly deposit period. In such cases, the employer must use Form 941 Schedule B to report their tax liabilities accurately.

Related forms include Form 941, the Employer's Quarterly Federal Tax Return, which provides an overview of an employer's quarterly tax liabilities. Form 941 Schedule B serves as a supplemental form to report detailed tax liability information for semiweekly schedule depositors.

Once completed, Form 941 Schedule B is submitted to the Internal Revenue Service (IRS). Employers can file the form electronically through the IRS's e-file system or mail a paper copy to the designated IRS address. It is important to note that individual states may have their own requirements regarding filing and submission methods.

Employers should retain a copy of the filed Form 941 Schedule B for their records. It is recommended to store these documents securely for at least four years, as they may be subject to future IRS audits or inquiries.

In summary, IRS Form 941 Schedule B is a crucial document for semiweekly schedule depositors to report their tax liabilities accurately. By providing essential information about employee wages, federal income taxes withheld, and other relevant details, this form ensures compliance with federal tax regulations.