OCFS-4743. Foster Parent Request for the Release of the Social Security Number of a Child in Foster Care for Income Tax Purposes

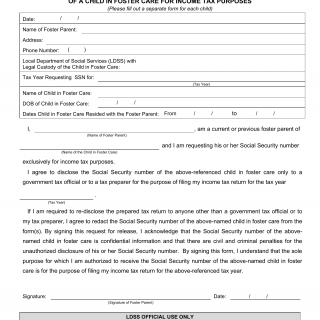

Form OCFS-4743 is a Foster Parent Request for the Release of the Social Security Number of a Child in Foster Care for Income Tax Purposes form used by the New York State Office of Children and Family Services. The purpose of this form is to allow foster parents to request the release of a foster child's social security number for income tax filing purposes.

The form consists of sections where the foster parent provides information about themselves, the foster child, and the specific tax year for which the social security number is needed. The form may also include an explanation of the purpose for which the social security number will be used.

Important fields in this form include accurate and specific information about the tax year and the purpose for which the social security number is being requested. Foster parents must obtain the necessary authorization to access a foster child's social security number and use it for legitimate income tax purposes.

Application Example: A foster parent caring for a child for an extended period needs to complete this form to request the foster child's social security number for income tax filing. The foster parent will provide details about their own tax filing and the need for the child's social security number to claim eligible tax credits.

No additional documents are mentioned in the form, but the foster parent may need to provide documentation to demonstrate their eligibility for the requested tax credits or deductions.

Related Form: OCFS-4742. This form might be used for reporting any changes or updates related to the foster child's social security number or the purpose for which it was requested.