Form LIC 405. Record Of Client's/Resident's Safeguarded Cash Resources - California

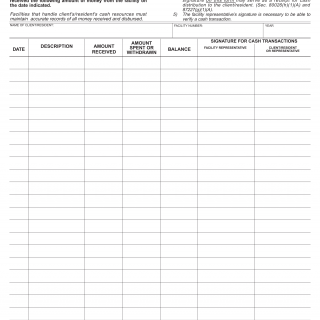

Form LIC 405 is used in California to maintain a record of a client's or resident's safeguarded cash resources within licensed facilities or programs. The main purpose of this form is to track and document any cash resources entrusted to the facility for safekeeping on behalf of the client or resident.

The form consists of sections where the licensee records information related to the client or resident and their safeguarded cash resources. This may include details such as the client's or resident's name, date of deposit, amount of cash received, and any accompanying documentation or receipts. The form may also provide space for additional notes or explanations.

Important fields on this form include accurately documenting the client's or resident's information, diligently recording all transactions involving safeguarded cash resources, ensuring transparency and accountability in managing the cash, and complying with any regulations or guidelines regarding the handling and safeguarding of cash. It is crucial for the licensee to establish proper procedures and controls to accurately complete the form and safely handle the cash resources.

Application Example: A residential care facility for individuals with developmental disabilities in California allows residents to deposit their personal funds for safekeeping. Form LIC 405 would be used to record each resident's cash deposits, withdrawals, or any other transactions involving safeguarded cash resources. By completing the form, the licensee maintains an accurate record of the resident's entrusted funds, promoting financial security and transparency.