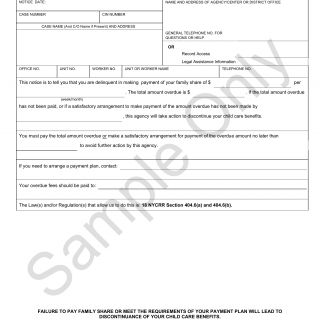

LDSS-4783. Delinquent Family Share for Child Care Benefits(Sample Only)

Form LDSS-4783 Delinquent Family Share for Child Care Benefits is a form used when a family has an overdue payment for childcare benefits from the New York State Office of Children and Family Services (OCFS). This form is intended to help families pay for childcare services they have already received, but have not yet paid for.

The form consists of several sections including a description of the family’s circumstances, the amount of the overdue payment, and a calculation of the proposed payment plan. Additional sections may include a declaration of the family’s financial situation, a statement of the family’s intention to pay the overdue amount, and any additional information the family wishes to provide. The parties involved in filling out this form include the family, OCFS, and the provider of the childcare services.

Important fields in this form include the overdue amount, the proposed payment plan, and the statement of financial situation. It is important to accurately fill out the form and provide all relevant information. Completing the form correctly is essential to ensure timely payment and to avoid any potential penalties or consequences.

An example of a situation where this form would be used is if a family fails to pay for childcare services they have already received. Completing this form would allow the family to make a payment plan with OCFS to pay for the overdue amount. The benefits of using this form are that it allows the family to make a payment plan that is reasonable and affordable for them.

Specific instructions for filling this form include providing an accurate description of the family’s financial situation and intention to pay, as well as providing accurate calculations for the proposed payment plan. Related forms and alternatives that may be available include the Child Care Assistance Program (CCAP) application and the Day Care Assistance application. Additional documents that may need to be provided include proof of income and any other relevant financial documents.