Freddie Mac Form 65. Fannie Mae Form 1003. Uniform Residential Loan Application

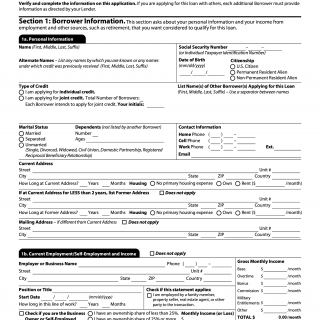

The Uniform Residential Loan Application, also known as Freddie Mac Form 65 or Fannie Mae Form 1003, is a standardized form used by lenders to gather information from borrowers who are applying for a residential mortgage loan.

The main purpose of this form is to provide lenders with a complete and accurate picture of a borrower's financial situation, including their income, assets, debts, and credit history. The form is used to assess the borrower's ability to repay the loan and to determine the terms and conditions of the loan.

The form consists of several parts, including sections for borrower information, employment and income, assets and liabilities, and details about the property being financed. Some of the important fields on the form include the borrower's name, social security number, and employment history. Additionally, the form requires information about the borrower's income, such as their salary, bonuses, and other sources of income.

When writing this form, borrowers will need to provide detailed financial information, including tax returns, bank statements, and pay stubs. They may also need to attach additional documents to support their application, such as proof of income or employment verification.

The parties involved in this form are the borrower and the lender. It is important to consider accuracy and completeness when filling out the form to avoid errors and potential loan denials.

One strength of this form is that it provides lenders with a comprehensive understanding of the borrower's financial situation, which can help to ensure that loans are made to borrowers who are capable of repaying them. However, a weakness of the form is that it can be time-consuming and complex to complete, which may deter some borrowers from applying for loans.

An alternative form to this is the Residential Loan Application, which is a similar form used by some lenders. The difference is that the Uniform Residential Loan Application is standardized and commonly used throughout the industry, while the Residential Loan Application may vary from lender to lender.

The completion of this form can have a significant impact on the future of the participants by determining their ability to obtain a mortgage loan and purchase a home. The form is submitted to the lender during the mortgage loan application process and is stored by the lender for record-keeping purposes.