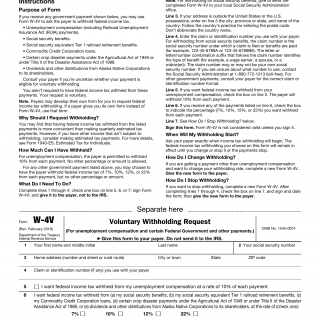

Form IRS W-4V. Voluntary Withholding Request

Form IRS W-4V - Voluntary Withholding Request serves as a request for voluntary tax withholding. The primary purpose of this form is to allow individuals receiving Social Security benefits to request the withholding of federal income tax from their benefits payments.

For example, a retiree who receives Social Security benefits and wants to ensure they have sufficient taxes withheld to avoid a tax bill at the end of the year would use this form. The form's purpose is to help individuals manage their tax obligations more effectively by withholding a portion of their benefit payments for tax purposes.

The parties involved are the individual receiving Social Security benefits and the IRS. This form consists of sections for personal information, the amount to be withheld, and the individual's signature. It is important for individuals to accurately complete this form to avoid unexpected tax liabilities.