Form VTR-425. Application for Surviving Spouse of a Veteran License Plates

The VTR-425 form, known as the Application for Surviving Spouse of a Veteran License Plates, is a crucial document provided by the Texas Department of Motor Vehicles (TxDMV). This application serves the purpose of allowing surviving spouses of eligible deceased veterans to apply for special license plates that honor their spouse's military service.

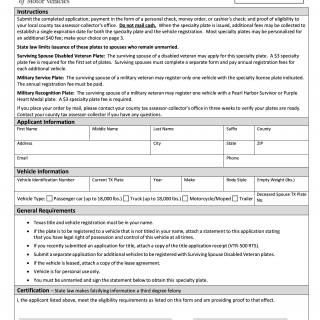

When filling out the VTR-425 form, it's important to consider several key points. The form consists of sections requiring detailed information from the applicant, such as full name, address, contact details, and driver's license number. Additionally, specific vehicle details like make, model, year, and vehicle identification number (VIN) are required.

To establish eligibility, applicants must provide supporting documentation, including a copy of the deceased veteran's death certificate and proof of the relationship to the veteran. These documents are crucial to demonstrating qualification for the special license plates.

Applications for the VTR-425 form can have various use cases. It enables surviving spouses to proudly display their deceased veteran spouse's military service on their vehicle license plates, serving as symbolic recognition of their contribution and sacrifice. By utilizing these specialized license plates, surviving spouses can pay tribute to their loved one's service while raising awareness and fostering a sense of pride within the community.

While there may not be direct related or alternative forms, it's worth noting that each state in the U.S. has its own equivalent programs for honoring veterans and their surviving spouses. However, the specific requirements and processes may vary from state to state.

After completion, the VTR-425 form can be submitted either in person at the local county tax office or through the mail to the designated address specified on the form. The TxDMV stores the submitted forms securely and processes them accordingly.

Remember that this information is based on my knowledge up until September 2021. It's essential to consult the most recent version of the form and verify any updates or changes with the TxDMV or your local county tax office for accurate and up-to-date information.