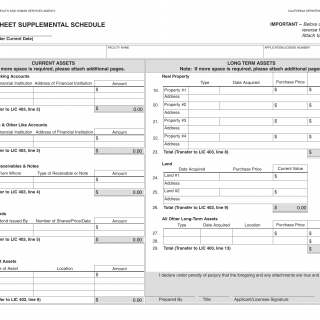

Form LIC 403A. Balance Sheet Supplemental Schedule - California

Form LIC 403A is used in California as a supplemental schedule to the balance sheet for licensed facilities or programs. The main purpose of this form is to provide additional details and breakdowns of specific assets, liabilities, or equity accounts mentioned in the balance sheet.

The form consists of sections where the licensee provides information related to the supplemental schedule. This may include itemized lists or tables that further specify the components of certain accounts mentioned in the balance sheet. The form typically aligns with the structure and classification of the corresponding balance sheet.

Important fields on this form include accurately documenting the relevant details and breakdowns required for specific accounts, ensuring consistency with the balance sheet amounts, and complying with any regulations or guidelines regarding financial reporting. It is crucial for the licensee to review the balance sheet and identify areas that require supplemental schedules when completing the form.

Application Example: An assisted living facility in California prepares a balance sheet as part of their financial reporting. Form LIC 403A would be used to provide a supplemental schedule for specific accounts, such as accounts payable or property assets. By completing the form, the licensee offers detailed information about the components of these accounts, providing transparency and a more comprehensive view of their financial position.

Related Forms: There are no specific related forms mentioned for Form LIC 403A. However, it serves as a supplemental schedule to the balance sheet (Form LIC 403), providing detailed breakdowns or explanations for specific accounts.