Form DTF-803. Claim for Sales and Use Tax Exemption - Title/Registration

DTF-803 Claim for Sales and Use Tax Exemption - Title/Registration is a form used in the state of New York to claim an exemption from sales and use tax for vehicle purchases. The main purpose of this form is to provide individuals or businesses with the opportunity to claim an exemption from sales and use tax when registering a vehicle in New York State.

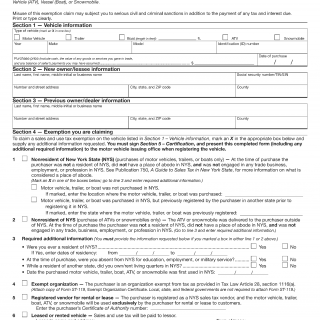

The form consists of several parts, including personal information about the individual or business claiming the exemption, a detailed description of the vehicle, and any supporting documentation that may be available. Important fields to consider when filling out this form include providing accurate and detailed information, as well as ensuring that all information provided is truthful and not misleading.

The parties involved in the DTF-803 Claim for Sales and Use Tax Exemption - Title/Registration include the individual or business claiming the exemption and the New York State Department of Taxation and Finance. It is important to note that the exemption can only be claimed if the vehicle is being registered in New York State.

When compiling/filling out the form, individuals or businesses will need to provide detailed information about the vehicle, including the make, model, year, and vehicle identification number (VIN). It is also important to include any personal information that may be relevant to the exemption claim.

Additional documents that may need to be attached to the form include a copy of the bill of sale, proof of payment of sales tax in another state, and any other relevant documentation that may help support the exemption claim.

Examples of application and use cases for the DTF-803 Claim for Sales and Use Tax Exemption - Title/Registration include purchases of vehicles for use in certain industries, such as farming or construction. The strengths of this form include providing individuals or businesses with a way to save money on sales and use tax when purchasing a vehicle for specific purposes. However, weaknesses may include the potential for fraudulent claims or misuse of the exemption.

Alternative forms or analogues to the DTF-803 Claim for Sales and Use Tax Exemption - Title/Registration may include other state-specific forms used to claim sales and use tax exemptions for specific purposes. However, the key difference is that this form is specific to New York State.

The future of participants who submit the DTF-803 Claim for Sales and Use Tax Exemption - Title/Registration may be impacted positively, as they may be eligible for a sales and use tax exemption on their vehicle purchase. However, it is important to note that eligibility for the exemption is subject to certain criteria and requirements.

The DTF-803 Claim for Sales and Use Tax Exemption - Title/Registration can be submitted in person or by mail to the New York State Department of Taxation and Finance, and is stored securely by the department for future reference.