Form DTF-802. Statement of Transaction Sale or Gift of Motor Vehicle

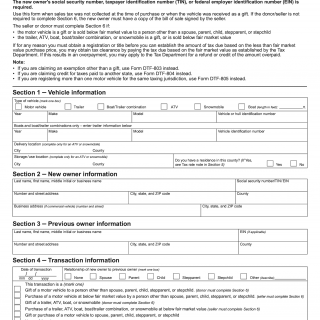

DTF-802 Statement of Transaction is a form used in the state of New York to report certain types of transactions to the New York State Department of Taxation and Finance. The main purpose of this form is to provide a record of a transaction that may be subject to state tax. Statement of Transaction – Sale or Gift of Motor Vehicle, Trailer, All-Terrain Vehicle (ATV), Vessel (Boat), or Snowmobile.

The form consists of several parts, including personal information about the individual or business involved in the transaction, a detailed description of the transaction, and any supporting documentation that may be available. Important fields to consider when filling out this form include providing accurate and detailed information, as well as ensuring that all information provided is truthful and not misleading.

The parties involved in the DTF-802 Statement of Transaction include the individual or business involved in the transaction and the New York State Department of Taxation and Finance. It is important to note that the purpose of this form is to report transactions that may be subject to tax, not to pay tax.

When compiling/filling out the form, individuals or businesses will need to provide detailed information about the transaction, including the date, amount, and a description of the goods or services involved. It is also important to include any personal information that may be relevant to the transaction.

Additional documents that may need to be attached to the form include copies of invoices, receipts, or other relevant documentation that may help support the transaction.

Examples of application and use cases for the DTF-802 Statement of Transaction include reporting the sale of a business or the transfer of ownership of property. The strengths of this form include providing a record of a transaction that may be subject to tax, which may help to ensure compliance with state tax laws. However, weaknesses may include the potential for errors or omissions in the information provided.

Alternative forms or analogues to the DTF-802 Statement of Transaction may include other state-specific forms used to report transactions that may be subject to tax. However, the key difference is that this form is specific to New York State.

The future of participants who submit the DTF-802 Statement of Transaction may be impacted positively, as they may be able to avoid penalties or fines for failing to report transactions that are subject to tax. However, it is important to note that failure to report transactions may result in penalties or fines.

The DTF-802 Statement of Transaction can be submitted electronically through the New York State Department of Taxation and Finance website, or by mail to the department. The form is stored securely by the department for future reference.