Form DFS-F1-SDF-1. Proof of Claim

The DFS-F1-SDF-1 form, also known as the Proof of Claim form, is used by creditors to file a claim in a bankruptcy case in the state of Florida. The main purpose of the form is to seek repayment for any debts owed to the creditor by the debtor.

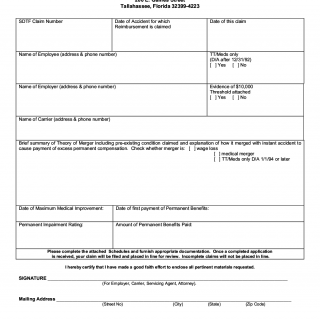

The form consists of several parts, including the creditor information section, the debtor information section, the claim information section, and the signature section. Important fields include the creditor's name, address, and contact information, the debtor's name and case number, the amount of the claim, and the reason for the claim.

The parties involved in the process of filing the Proof of Claim form include the creditor, the debtor, and the bankruptcy court. It is important to consider deadlines when compiling the form, as there are specific time frames for filing the form and for objecting to claims.

Data required to compile the form includes the creditor's contact information, the debtor's case number, and the amount of the claim. Additionally, supporting documents such as invoices, contracts, and promissory notes may need to be attached to the form.

Application examples and use cases for the Proof of Claim form include filing a claim for unpaid wages, unpaid rent, or other debts owed by the debtor. Benefits of filing a Proof of Claim form include the possibility of receiving payment for debts owed. Challenges and risks include the possibility of the claim being objected to by the debtor or the court, or the claim being denied altogether.

Related and alternative forms include the Official Form 410 Proof of Claim, which is a national form used in bankruptcy cases, and the Florida Bankruptcy Court's Local Form 3015-1, which is used to file a claim in a chapter 13 bankruptcy case. The main difference between the DFS-F1-SDF-1 form and these forms is that the DFS-F1-SDF-1 form is specific to the state of Florida.

Filing the Proof of Claim form can affect the future of the parties involved, as it may result in the creditor receiving payment for debts owed, and the debtor potentially having their bankruptcy case dismissed or receiving a discharge of debts. The form is submitted to the bankruptcy court where the case is being heard, and is stored as part of the case record.