Federal Financial Report (FFR)

The Federal Financial Report (FFR) is an official document used for reporting financial information related to federal grants or awards. It is submitted by recipient organizations to the federal agency that provided the grant. The FFR serves as a tool for tracking financial expenditures, ensuring compliance with grant terms, and providing transparency in the use of federal funds. This form helps federal agencies monitor the financial aspects of grant-funded projects and ensures that funds are used appropriately.

Usage Case: The FFR is typically used by organizations and entities that receive federal grants, including state and local government agencies, nonprofit organizations, educational institutions, and other entities that receive federal financial assistance. Recipients of federal grants are required to submit this report to the awarding federal agency on a periodic basis, which may be quarterly, semi-annually, or annually, as specified in the award agreement.

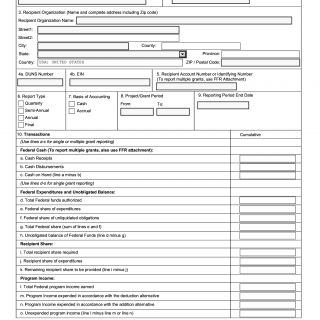

Key Structure and Sections:

-

Federal Agency and Organizational Element to Which Report is Submitted: This section includes information about the federal agency to which the report is submitted.

-

Federal Grant or Other Identifying Number Assigned by Federal Agency: It provides the identification number for the specific federal grant being reported.

-

Recipient Organization: The name and address of the recipient organization, including DUNS number, EIN, and account number, are provided.

-

Report Type: The type of report (quarterly, semi-annual, or annual) is selected.

-

Basis of Accounting: The basis of accounting, either accrual or cash, is indicated.

-

Project/Grant Period: The period during which the federal sponsorship is effective is specified.

-

Reporting Period End Date: The date marking the end of the reporting period is recorded.

8-10: These sections detail financial transactions, including cash receipts, disbursements, unobligated balances, federal expenditures, recipient share, and program income.

-

Indirect Expense: This section, if required, provides information on indirect cost rates and charges.

-

Remarks: Any additional explanations or information required by the federal agency are provided in this section.

-

Certification: The certifying official signs, prints their name, and provides contact information. They certify that the report is accurate and complete to the best of their knowledge.

-

Agency Use Only: Reserved for federal agency use.

The FFR is a critical tool for accountability and compliance in managing federal grants. It ensures that federal funds are used appropriately, promotes transparency, and helps federal agencies monitor the financial aspects of grant-funded projects.