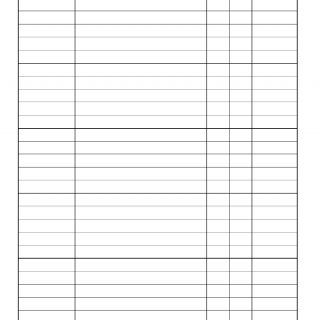

DA Form 4079. Depreciation Expense Control (Furniture Fixtures and Equipment)

DA Form 4079, also known as the Depreciation Expense Control (Furniture Fixtures and Equipment) form, is used by the Department of Army to track and control the depreciation expenses associated with furniture, fixtures, and equipment.

The main purpose of this form is to provide a systematic way to record and monitor the depreciation of assets over time. It helps in maintaining accurate financial records and determining the value of assets for accounting and reporting purposes.

The form consists of several important fields that need to be filled out accurately. These include:

- Asset Information: This section requires details about the asset, such as the description, serial number, acquisition date, and cost.

- Depreciation Calculation: Here, you will enter information related to the depreciation calculation, including the useful life of the asset, the method used for depreciation, and the annual depreciation expense.

- Accumulated Depreciation: This field tracks the total depreciation accumulated over time.

- Book Value: It represents the net value of the asset after deducting the accumulated depreciation from the original cost.

When filling out DA Form 4079, it is crucial to ensure accuracy and completeness of the information provided. Any errors or omissions can lead to incorrect financial reporting and misrepresentation of asset values.

An example of application for this form would when a military unit acquires new furniture, fixtures, or equipment. The form would be used to record the details of the assets, calculate their depreciation, and track the accumulated depreciation over time.

There are direct alternatives or analogues to Form 4079 within the Department of Army forms. However, similar forms may exist in other organizations or industries for tracking depreciation expenses of assets.