Estate Planning Power of Attorney

An Estate Planning Power of Attorney (POA) is a legal document that allows one person to appoint another person to make decisions and act on their behalf in relation to their estate planning matters. This can include decisions related to managing their assets, paying bills, and making healthcare decisions.

The Estate Planning POA typically consists of several parts. The first part identifies the parties involved, including the person granting the power of attorney (the "principal") and the person who will be acting on their behalf (the "agent" or "attorney-in-fact"). The document will also contain a section that outlines the specific powers that the agent will have, such as the ability to sell property, make healthcare decisions, and manage investments.

It is important to note that an Estate Planning POA is typically drawn up when the principal is still alive and able to make decisions for themselves. This is in contrast to a will, which outlines how a person's assets will be distributed after they pass away.

The parties involved in an Estate Planning POA are the principal and the agent. The principal grants the power of attorney to the agent, allowing them to act on their behalf in estate planning matters. It is important to choose an agent who is trustworthy and capable of making important decisions. The agent may be a family member, friend, or professional such as a lawyer or financial advisor.

When compiling an Estate Planning POA, it is important to take into account several features. First, the document should be clear and specific about the powers that are being granted to the agent. It should also outline any limitations or conditions that may apply. Additionally, the document should be executed in compliance with applicable laws and regulations in the jurisdiction where it is being created.

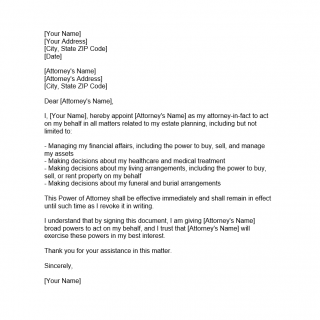

Short sample of POA:

[Your Name]

[Your Address]

[City, State ZIP Code]

[Date][Attorney's Name]

[Attorney's Address]

[City, State ZIP Code]Dear [Attorney's Name],

I, [Your Name], hereby appoint [Attorney's Name] as my attorney-in-fact to act on my behalf in all matters related to my estate planning, including but not limited to:

- Managing my financial affairs, including the power to buy, sell, and manage my assets

- Making decisions about my healthcare and medical treatment

- Making decisions about my living arrangements, including the power to buy, sell, or rent property on my behalf

- Making decisions about my funeral and burial arrangementsThis Power of Attorney shall be effective immediately and shall remain in effect until such time as I revoke it in writing.

I understand that by signing this document, I am giving [Attorney's Name] broad powers to act on my behalf, and I trust that [Attorney's Name] will exercise these powers in my best interest.

Thank you for your assistance in this matter.

Sincerely,

[Your Name]

The advantages of an Estate Planning POA are numerous. It allows the principal to have peace of mind knowing that their affairs will be managed by someone they trust if they become unable to make decisions for themselves. It also streamlines the decision-making process and can help avoid potential conflicts between family members or other interested parties.

If an Estate Planning POA is not filled out correctly, there can be several problems. For example, if the document is not executed in compliance with applicable laws and regulations, it may not be legally valid. Additionally, if the powers granted to the agent are not specific enough, it can lead to confusion and potential disputes. Finally, if the agent is not trustworthy or capable of making important decisions, it can lead to mismanagement of the principal's affairs.

A examples of when an Estate Planning Power of Attorney form might be used:

- In the event of a sudden illness or accident: If the principal becomes unable to make decisions for themselves due to a sudden illness or accident, the agent named in the Estate Planning POA can step in and manage their affairs. This might include decisions related to healthcare, financial matters, and property management.

- During a period of extended travel or absence: If the principal is planning to be away from home for an extended period of time, they may choose to grant power of attorney to an agent to manage their affairs while they are away. This can include paying bills, managing investments, and making other important decisions.

- In the event of a decline in mental or physical health: As individuals age, they may experience a decline in their physical or mental health. In such cases, an Estate Planning POA can be used to ensure that their affairs are managed by someone they trust if they become unable to make decisions for themselves.

- To avoid potential conflicts between family members: In some cases, family members may disagree about how to manage a loved one's affairs. By granting power of attorney to a trusted agent, the principal can help avoid potential conflicts and ensure that their affairs are managed in accordance with their wishes.

In each of these cases, an Estate Planning Power of Attorney form can help ensure that the principal's affairs are managed in accordance with their wishes, even if they are unable to make decisions for themselves. It can provide peace of mind for the principal and their loved ones, and help avoid potential conflicts or disputes.