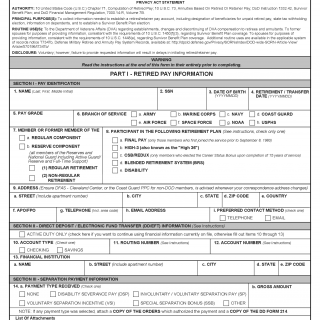

DD Form 2656. Data for Payment of Retired Personnel

DD Form 2656, also known as Data for Payment of Retired Personnel, is a form used by the Department of Defense to collect data for the payment of retired personnel.

The main purpose of this form is to collect information about the retiree, their dependents, and their banking information so that the Department of Defense can accurately pay retirement benefits. The form consists of several parts, including personal information, military history, dependency information, and banking information.

Important fields on the form include the retiree's full name, social security number, and military service number. It is also important to provide accurate information about dependents, including their full names, social security numbers, and dates of birth. Additionally, banking information must be provided, including the routing number and account number for direct deposit of retirement benefits.

Parties involved in the form include the retiree, their dependents, and the Department of Defense. When writing the form, it is important to consider accuracy and completeness of the information provided, as errors or omissions can delay retirement benefit payments.

Documents that must be attached to the form include a copy of the retiree's DD Form 214, Certificate of Release or Discharge from Active Duty, and any supporting documentation for dependents, such as birth certificates or marriage certificates.

Application examples and use cases for this form include military retirees who are eligible for retirement benefits and need to provide accurate and complete information to ensure timely and accurate payment of benefits.

Strengths of this form include its ability to collect all necessary information in one place and its standardized format. Weaknesses include the potential for errors or omissions and the need for supporting documentation.

Related forms and analogues include the SF 3108, Application to Make Service Credit Payment, and the SF 2801, Application for Immediate Retirement. The main difference between these forms is their specific purpose and the type of retirement benefits they apply to.

The form affects the future of the participants by ensuring timely and accurate payment of retirement benefits.

The form is submitted to the Defense Finance and Accounting Service (DFAS) and can be submitted online or by mail. The form is stored in the retiree's official military personnel file.