Form 4054. Missouri Power of Attorney

Form 4054 - Power of Attorney is a crucial document issued by the Missouri Department of Revenue. It serves as a legally binding authorization that allows an individual or entity to act on behalf of another party in matters related to tax administration and compliance. This form plays a pivotal role in streamlining communication and ensuring efficient handling of tax-related affairs.

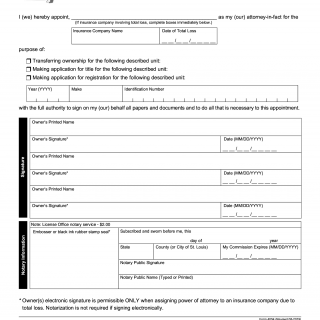

The Power of Attorney form consists of several important fields that must be accurately filled out. These include the taxpayer's information, such as name, address, Social Security Number (SSN), and tax identification number. Additionally, the form requires details about the authorized representative, including their name, address, contact information, and relationship to the taxpayer.

When completing the form, it is vital to provide accurate and up-to-date information to avoid any discrepancies or delays in processing. Moreover, both the taxpayer and the authorized representative must sign and date the document to validate its authenticity.

While filing Form 4054, certain data will be required, such as the specific tax types and periods the Power of Attorney applies to. It is essential to carefully review and understand the instructions provided with the form to ensure all necessary information is included.

In addition to the completed form, certain supporting documents may need to be attached. These could include copies of identification documents for both the taxpayer and the authorized representative, proof of the representative's authority to act on behalf of the taxpayer (such as letters of authorization), and any other relevant documentation requested by the Missouri Department of Revenue.

Examples of application scenarios where Form 4054 might be needed include situations where a taxpayer requires assistance from a trusted representative, such as an accountant or tax attorney, to handle tax-related matters. This could involve filing taxes, responding to inquiries from the Department of Revenue, or resolving disputes.

It is worth noting that there may be related forms or alternative processes available depending on the nature of the tax issue. For instance, individuals or entities seeking to grant a Power of Attorney specifically for income tax matters may need to use different forms or processes compared to those involving sales tax or property tax.

Once completed, Form 4054 can be submitted to the Missouri Department of Revenue through various channels, such as mail, fax, or electronically via their online portal. It is advisable to retain a copy of the form and any accompanying documents for personal records.

The submitted form and associated documents are typically stored securely by the Missouri Department of Revenue, ensuring confidentiality and accessibility for future reference or verification purposes.

In summary, Form 4054 - Power of Attorney is a vital document used in tax-related matters in Missouri. It allows individuals or entities to authorize representatives to act on their behalf. Accurate completion, adherence to instructions, and inclusion of required supporting documents are crucial for a smooth and efficient process.