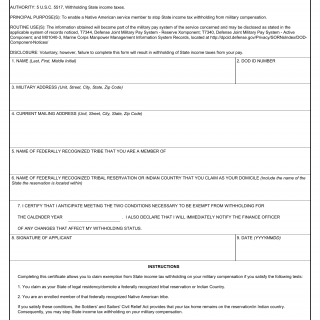

DD Form 2058-2. Native American State Income Tax Withholding Exemption Certificate

DD Form 2058-2, known as the Native American State Income Tax Withholding Exemption Certificate, is used by Native American individuals to claim exemption from state income tax withholding in the state where they are employed.

The form consists of sections for personal information, tribal affiliation, and certification of exemption. It aims to establish the eligibility of the individual for withholding tax exemption based on their Native American status and tribal affiliation.

When filling out DD Form 2058-2, it is important to accurately provide personal details, tribal affiliation, and the necessary certifications. Proof of tribal membership or affiliation may be required to support the exemption claim.

Application Example: A Native American employed on a reservation might use this form to claim exemption from state income tax withholding for income earned within their tribe's jurisdiction. The form ensures that the appropriate tax treatment is applied to their earnings.

No direct alternative forms are mentioned, but similar tax exemption forms might exist for other specific circumstances in various states.