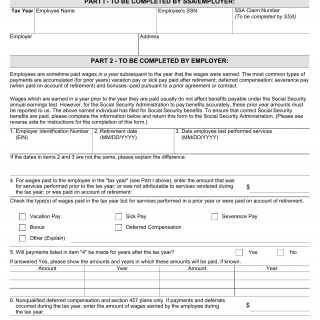

Form SSA-131. Employer Report of Special Wage Payments

Form SSA-131, Employer Report of Special Wage Payments, is used by employers to report special wage payments made to employees. This form's primary purpose is to report specific types of wage payments that may impact a person's Social Security benefits or earnings record.

For example, if an employer provides a one-time bonus or other special wage payment to an employee, they would use this form to report it to the Social Security Administration. The purpose is to ensure that these payments are accurately recorded and do not result in overpayment or underpayment of benefits to the employee.

The parties involved include the employer making the special wage payment and the Social Security Administration. The form consists of sections for the employer's information, employee details, and a description of the special wage payment. Accurate reporting is essential to avoid discrepancies in an individual's benefits or earnings record.