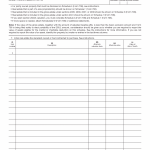

How cash, notes, and similar financial interests are reported under IRS Form 706

Cash, promissory notes, and comparable financial interests are included in the Form 706 process when the decedent held liquid assets or enforceable rights to receive payment at the time of death.

How stocks and bonds are reported and valued under IRS Form 706

Stocks, bonds, and similar marketable securities become part of the Form 706 process when the decedent held ownership interests in publicly traded or closely held financial instruments at the time of death.

How real estate is reported and valued under IRS Form 706

Real estate becomes part of the Form 706 process when the decedent owned, or had a legally enforceable interest in, land or buildings at the time of death.

How the IRS Form 706 filing process works from start to final tax outcome

The filing of Form 706 is a structured process through which the Internal Revenue Service evaluates an estate after a decedent’s death.

When IRS Form 706 is required and why the filing obligation arises

The requirement to file Form 706 arises when a decedent’s death places the estate within the federal estate and generation-skipping transfer tax system. This obligation is not limited to situations where estate tax is ultimately due.

IRS Form 706 estate tax return overview and how the filing process works

Form 706 is used when a decedent’s estate must be evaluated under the federal estate and generation-skipping transfer tax system, either because the value of the estate exceeds statutory thresholds or because the filing is required to preserve specific tax positions such as portability.

How to pay the Form 2290 tax

If Form 2290 results in a tax due, payment is required as part of the filing process, and the payment method used affects how the return is processed and when Schedule 1 becomes available.

Form 2290 credits and refunds

If circumstances change after Form 2290 is filed, such as a vehicle being sold, destroyed, or stolen, the Heavy Highway Vehicle Use Tax previously reported may no longer fully apply for the entire tax period, which can result in a credit or refund situation.

Amended Form 2290 and corrections

If information reported on Form 2290 changes after filing, or if an error is discovered, the return may no longer accurately reflect the vehicle’s tax status for the current tax period and requires correction.

Used vehicles and mid-period purchases on Form 2290

If a heavy highway vehicle is purchased or otherwise acquired during the tax period, Form 2290 becomes relevant based on when the vehicle is first used on public highways rather than the date of purchase.