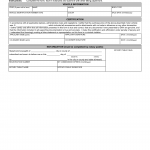

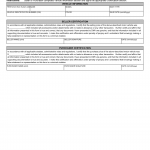

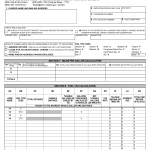

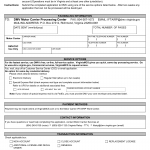

Form SUT 2A. Refund of Sales and Use Tax Application and Affidavit - Virginia

Form SUT 2A - Refund of Sales and Use Tax Application and Affidavit is used to request a refund of Sales and Use Tax paid to the DMV for a vehicle that was returned to the seller due to a mechanical defect or failure. This form is essential for individuals who need to obtain a refund for taxes paid on a vehicle that had to be returned due to a defect.