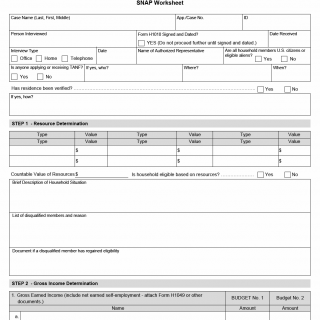

TX HHS Form H1801. SNAP Worksheet

Form H1801, known as the SNAP Worksheet, is an internal eligibility and calculation document used in the administration of the Supplemental Nutrition Assistance Program (SNAP). It is primarily completed by eligibility workers during the interview and verification process to document household information, resources, income, and compliance with program requirements.

Although applicants usually do not fill out this form themselves, the information recorded on Form H1801 directly affects whether a household qualifies for SNAP benefits and the amount of assistance approved.

Purpose of Form H1801

The main purpose of Form H1801 is to provide a structured way to evaluate SNAP eligibility. It brings together information from interviews, supporting documents, and related forms to ensure that decisions are consistent, traceable, and compliant with federal and state rules.

This worksheet is used during initial applications, recertifications, and certain change reviews when household circumstances must be reassessed.

Who Uses This Form

Form H1801 is typically completed by:

- SNAP eligibility workers or case managers

- State or local agency staff administering food assistance programs

- Authorized representatives acting on behalf of an applicant, when permitted

Applicants may be asked questions that correspond to this worksheet, but they usually do not submit the form directly.

Overview of Key Sections

Applicant and Case Information

This section identifies the household and the case being reviewed. It includes the case name, application or case number, interview date, interview type (office, home, or telephone), and confirmation that Form H1010 has been signed and dated.

A signed application is mandatory. If Form H1010 is not properly completed, eligibility determination cannot proceed.

Citizenship and Program Participation

The worksheet records whether all household members are U.S. citizens or eligible non-citizens and whether anyone in the household is applying for or receiving Temporary Assistance for Needy Families (TANF). These answers affect eligibility rules and income calculations.

Residence Verification

This part documents whether the household’s residence has been verified and how verification was obtained. Proof of residence is a standard SNAP requirement and must be clearly documented.

Step 1 – Resource Determination

In this section, the worker lists household resources, their types, and values. The countable value of resources is calculated to determine whether the household meets SNAP resource limits.

This section also includes space for:

- A brief description of the household situation

- Identification of any disqualified household members

- Documentation if a previously disqualified member has regained eligibility

Step 2 – Gross Income Determination

This section records gross earned income, including wages and self-employment income. If self-employment income is involved, Form H1049 or similar documentation must be attached.

Income may be organized into separate budget calculations when required, ensuring transparency in how totals are determined.

When This Worksheet Is Required

Form H1801 is required whenever a SNAP case requires a documented eligibility decision, including:

- Initial SNAP applications

- Periodic recertifications

- Reviews triggered by reported changes in income or household composition

- Quality control or audit reviews

It is not used as a standalone application form and should not be submitted by applicants unless specifically requested by the agency.

Common Mistakes and Issues

- Proceeding without a signed and dated Form H1010

- Incomplete documentation of income or resources

- Failure to attach required self-employment forms

- Unclear explanations for disqualified household members

- Missing residence verification details

These issues can lead to delays, incorrect benefit amounts, or case denials.

Practical Tips for Accurate Completion

- Verify all supporting documents before recording figures

- Clearly describe household circumstances in plain language

- Double-check resource and income totals

- Ensure all related forms are signed and dated

- Document changes and exceptions thoroughly

Real-Life Use Examples

- A caseworker completes Form H1801 after interviewing a family applying for SNAP for the first time.

- An eligibility review is conducted after a household reports new employment income.

- A previously disqualified household member regains eligibility and the change must be documented.

Documents Commonly Referenced or Attached

- Form H1010 (Application for Assistance)

- Form H1049 for self-employment income

- Pay stubs or employer statements

- Proof of residence

- Citizenship or immigration status documentation

Frequently Asked Questions

Is Form H1801 filled out by the applicant?

No. It is usually completed by an eligibility worker based on information provided by the applicant.

Does this form determine SNAP approval?

Yes. The information recorded supports the official eligibility decision.

Is a signed application required before using this worksheet?

Yes. Form H1010 must be signed and dated before proceeding.

What happens if income is not documented correctly?

The case may be delayed, denied, or approved with an incorrect benefit amount.

Is Form H1801 submitted to the applicant?

No. It is kept as part of the agency’s case record.

Micro-FAQ

- Purpose: Documents SNAP eligibility and benefit calculations.

- Who completes it: Eligibility workers or authorized staff.

- Used for: SNAP applications, reviews, and recertifications.

- Attachments: Income and resource verification forms.

- Submission: Retained in the agency case file.

Related Forms

- Form H1010 – Application for Assistance

- Form H1049 – Self-Employment Income

- SNAP Recertification Forms

Form Details

- Form Name: SNAP Worksheet

- Form Number: H1801

- Program: Supplemental Nutrition Assistance Program (SNAP)

- Region: United States (state-administered)

- Revision Date: November 2017